Geotab study finds nearly 40% of UK fleet vehicles could go electric today and still save money

Table of contents

- Top level results and insights

- Introduction

- Questions to ask outside of the EV early adopters circle

- Data-on-wheels approach shows the opportunity for fleet electrification

- Insight #1: The economics of electrification stack up for nearly 40% of fleet vehicles

- Insight #2: Incentives continue to play a role in EV adoption

- Insight #3: More than 40% of UK passenger fleet vehicles are within EV range

- Insight #4: On-route charging strategies can help tip the balance

- Conclusion: A cost saving exercise, not an expense

Top level results and insights

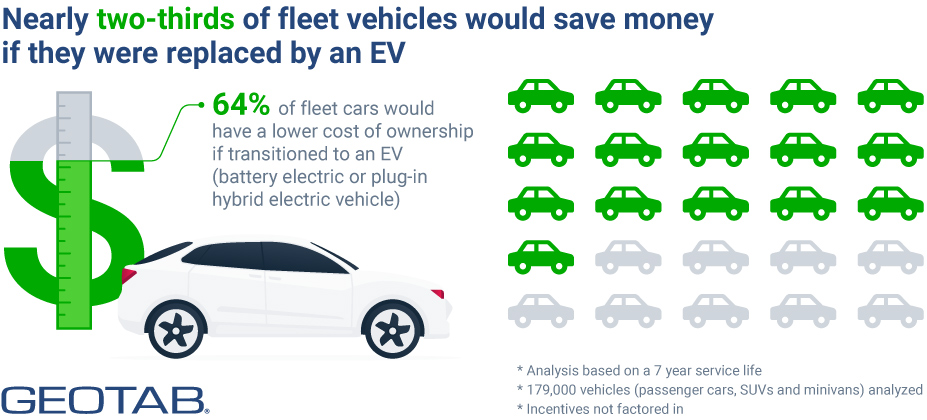

- The economics of electrification stack up for nearly 40% of fleet vehicles. Of the more than 3,400 analysed, over 1,300 of those vehicles can switch to electric today and save money over the vehicle’s life.

- Incentives continue to play a role. With a £2,500 incentive, the percentage of passenger vehicles that are cost competitive increases by 18%, and with a £6,000 incentive, the percentage of vans increases by 7%.

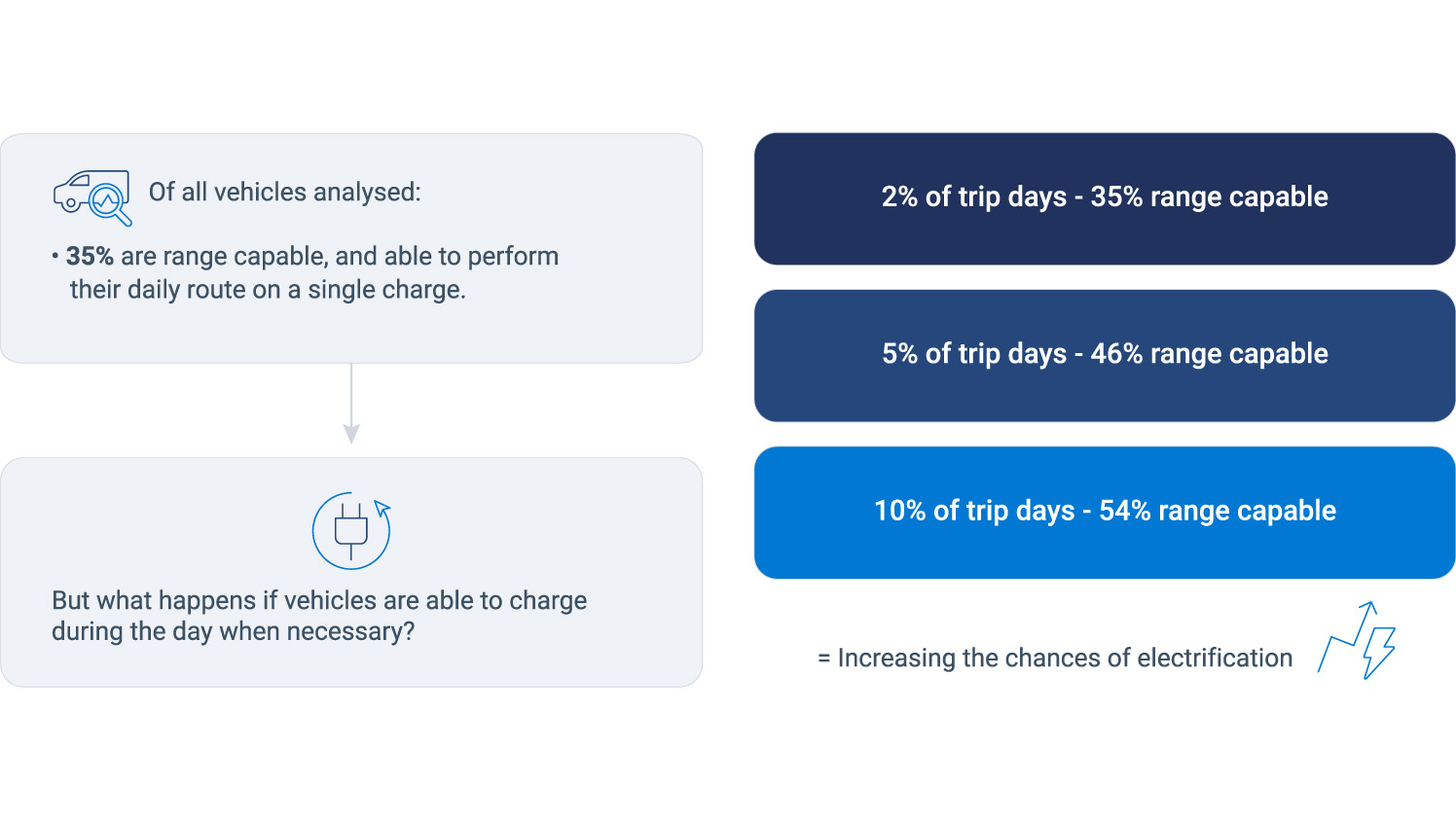

- Of the UK passenger vehicle fleets today, over 40% could be replaced with a range-capable fully electric vehicle.On-route charging strategies can help tip the balance. Daytime charging can increase vehicle range capability from 35% to over 50%.

Introduction

The ban of new petrol and diesel vehicles is swiftly approaching: 2030 for passenger vehicles and vans; 2040 for heavy goods vehicles. With this, a number of businesses and public sectors have set ambitious targets for fleet electrification.

For example, Saint Gobain UKI is aiming for their company car fleet of over 3,000 vehicles to be fully-electric by 2023, Centrica has set an ambitious target of 2025 for the whole fleet and the UK Government has committed to electrify the entire fleet of government cars and vans by 2027.

That being said, this is not like-for-like vehicle replacement. Electric vehicles (EVs) pose new opportunities and challenges for fleets. Challenges come in the form of questions that didn’t require an answer before and operational adjustments that now require strategic planning. With that said, a portion of fleet operators have taken a leap and realised the possible operational savings. The early adopters are paving a way for the rest of the industry. While the journey may be different for each operator, the end goal is the same: vehicle electrification.

Early adopters are predominantly located in the passenger and light-duty vehicle segments as there are numerous EVs already available that meet their needs. However, this will change over time, allowing the heavy-duty market to consider electrification. This is possible due to strong commitments from vehicle manufacturers, with the expectation of hundreds of new models across various segments in the coming years.

The UK Government offers an array of incentives to encourage EV adoption amongst fleets including:

- Purchase incentives for the vehicle and charging infrastructure

- Tax breaks

- Exemptions

Furthermore, a surge of employers are now offering EVs to their employees through salary sacrifice and favourable benefit-in-kind rates.

Questions to ask outside of the EV early adopters circle

- Will an EV do what I need it to do? In other words, will the range of the EV be able to carry out the same job as the current petrol or diesel vehicle?

- At what cost? We know that the initial purchase price of an EV across most segments is more expensive, but how do the financials look over the vehicle’s life?

- How can EVs reduce tailpipe emissions? As businesses look to decarbonise, am I able to quantify the amount of CO2 saved by switching to an EV.

At Geotab, we are leading the way as every day our partners and customers utilise the Electric Vehicle Suitability Assessment (EVSA) to answer the very important questions posed above.

What sets this study apart from Geotab’s EVSA is the aggregation of anonymised vehicle data with Geotab technology that aims to understand, from a broader perspective, what the UK fleet's electrification potential is.

Do the vehicles’ daily operating cycles lend themselves to the range capability of an EV? What portion of the fleet could actually transition to electric today and save money in the process? These questions and more were answered by this study.

Data-on-wheels approach shows the opportunity for fleet electrification

Powered by Geotab’s EVSA using anonymised and aggregated data sets, we analysed more than 3,400 vehicles operating in the UK across 51 customers and within 14 industries to determine their EV suitability today.

Our analysis considers the actual daily vehicle usage and compares this to the real world range performance of EVs on the market today. It also takes into account factors like operating temperature.

Following this, we analysed the total cost of ownership of the petrol and diesel vehicles operating in the fleet, and made the comparison against a new EV, factoring in costs such as fuel, electricity and maintenance.

The Geotab team found that the results exceeded even our initial expectations. More fleets than anticipated have vehicles that can switch to electric today, and use it as a cost-saving exercise rather than an expense — data allows fleets to identify where the cost savings are.

To see the top line results from this study, keep reading.

Insight #1: The economics of electrification stack up for nearly 40% of fleet vehicles

For any business, the numbers need to stack up. While the upfront cost of an EV can be higher than an internal combustion engine (ICE) vehicle, over the vehicle’s lifetime, the equation can reach parity and even cost less in eight years based on this analysis. Of the more than 3,400 vehicles analysed, 39% could switch to an EV today, and be cost effective.

The savings from EVs can be realised in everything but the upfront cost (though these costs are declining as price parity is expected to be reached by 2027). EVs are exempt from road tax, as well as clean air zones that are becoming more commonplace across cities in the UK.

Furthermore, they create savings opportunities during operation with every electric mile you are saving on fuel and maintenance costs. The cost of electricity can be as much as 4x cheaper than petrol or diesel per mile. Similarly, with fewer mechanical components, maintenance is likely to be at least 30% less expensive than for an internal combustion vehicle. In addition, we can’t forget to mention the tax benefits for company car drivers.

The main takeaway is: when evaluating the financial impact of purchasing a vehicle, you need to take into account the costs of ownership for the entire holding period (Average length of ownership is eight years), as opposed to just the initial or acquisition costs. You might be surprised to find savings as opposed to costs when acquiring an EV.

Insight #2: Incentives continue to play a role in EV adoption

The UK Government offers an array of financial grants to incentivise the uptake of EVs. These incentives will continue to play an important role in EV feasibility. For example, grants for cars start at £2,500, up to £6,000, for large vans and £16,000 for trucks. Grants are also available for the purchase and installation of charging infrastructure.

Similarly, in Ireland, businesses are eligible for grants of €3,800 for battery-electric and plug-in hybrid vehicles and €600 for charging infrastructure.

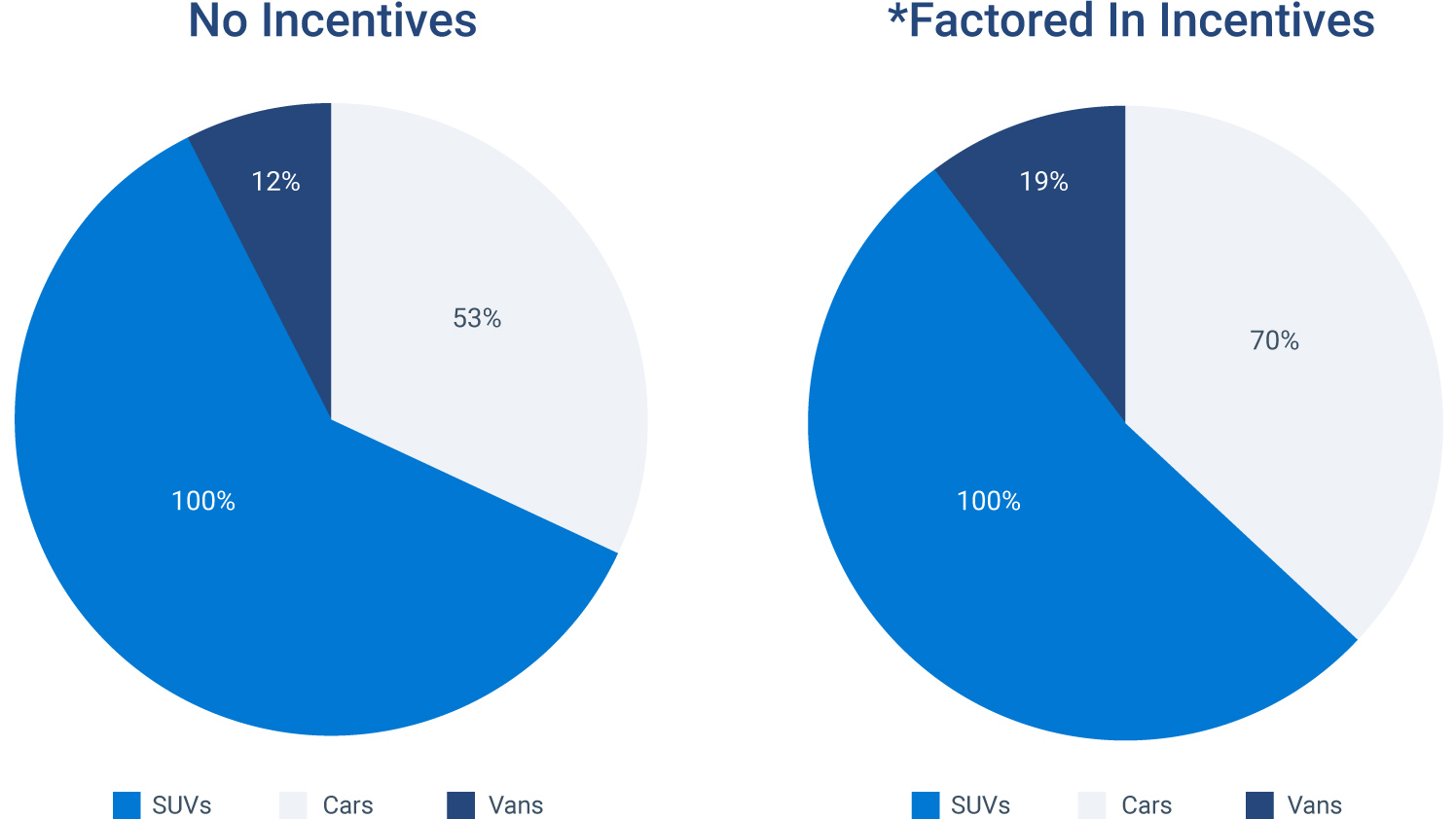

| A | B | C |

| Incentive | None | Factored in* |

| Cars | 53% | 70% |

| SUVs | 100% | 100% |

| Vans | 12% | 19% |

(Percentages reflect the number of vehicles that have a lower total cost of ownership when switching to an EV)

*£2,500 for passenger cars & SUVs, £6,000 for Vans

Although these grants were introduced in an effort to reduce the upfront cost of EV acquisition, they can be seen as a way to reduce the total cost of ownership. While the UK Government has signaled purchase incentives will not last forever, they can tip the balance today on the economic equation.

Our analysis shows the impact of incentives is strongest in the passenger fleet, moving from 53% to 70% when applying a £2,500 incentive. Similarly, the percentage of feasible vans for electrification increases by 7%.

The key takeaway here is not to rule out the implications of incentives. It is helpful to understand what financial incentives are available and apply them to your economic modelling of EV transition — they might just tip the balance in favour of electrification.

Insight #3: More than 40% of UK passenger fleet vehicles are within EV range

In the UK, new plug-in passenger vehicles sales now sit at more than 10% of all new vehicle sales. The car market has been the first to react to electrification with significantly greater model choices than other vehicle categories and cost competitiveness.

Range anxiety remains a concern amongst fleet operators. Being able to complete the route without running out of charge is a main priority. When the data is put out there, many may be surprised by how many miles a vehicle usually drives on a daily basis.

Our analysis shows that, today, 42% of vehicles analysed are within EV range. This means that, for 42% of the ICE vehicles in operation, there is an EV with comparable range on the UK market that can complete the same amount of miles without requiring a daytime charge.

Each and every year, new vehicle models are entering the market with greater range capabilities that are price competitive. This may not be a concern over time, however, having the data front and centre can show you in no uncertain terms what is possible.

In order to make an effective transition to electric vehicles, it is important to be both range capable and cost effective. What it does signal is how EVs are increasingly becoming the vehicle of choice from a financial perspective.

We know that the upfront cost of EVs can be more expensive, but over the vehicle’s life it can increase the possibility of becoming cost competitive.

With every electric mile you drive, you have the potential to save. The more you drive an EV, the greater the financial benefits can be. This is particularly true through fuel, maintenance and service outlays. Knowing this information, the transition to electric shouldn’t be a cost exercise, it's more about the savings that can be made over the vehicle’s lifetime.

Insight #4: On-route charging strategies can help tip the balance

The strongest fleet use case for vehicle electrification today is operating throughout the day and charging in a centralised location during off-duty hours. This essentially equates to depot-based fleets, which draw a number of advantages, including:

- No potential productivity loss by charging during operating hours

- No need to rely on public charging stations

- Charging during off-peak time for lower electricity tariffs

However, opening up these avenues will create more opportunities for fleets to electrify. Our analysis uses a baseline of no daytime charging to provide results. These results show that access to daytime charging could increase the viability of EVs with the required range by as much as 50% across the fleet.

The UK Government has ambitious plans to expand the public charging network. Today, the number of charging stations across the UK stands at 25,000. Forecasts suggest a ten-fold increase is required by 2030. Furthermore, home charging provides an ample opportunity to charge for those with access to off-street parking. These number help support the actions of one-third of UK businesses that are planning to install charge points at their employees homes.

These results show that when it comes to strategy, more comprehensive choices can enable a greater number of UK fleets to transition without having to worry about charging opportunities.For example, from our analysis, an average of 5-days of on-route charging has the potential to increase the number of range capable vehicles by more than double.

However, this won’t only be about providing more charging options. It will also require the technology to tell an operator what the real-time remaining range is, locations of charging, availability, charge power/time to sufficient charge level and cost. Visibility and insight will provide greater confidence in the viability of on-route charging opportunities.

Conclusion: A cost saving exercise, not an expense

What can we take away from this? The deadline for the ban on ICE vehicles is quickly approaching, and the planning for a fully-electric fleet will take time. However, what we can see is that a significant proportion of fleet vehicles could be replaced with an EV today and save money in the process.

As more options enter the market across all vehicle segments and at competitive price points, the opportunity for electrification will only increase overtime. Fleets that make their own commitments today will benefit from the experience in electrifying their fleet operations and use that moving forward. By adopting EVs into your fleet now, you can get a handle on the data and insights that are applicable to the journey ahead.

Large studies of this kind are necessary to understand the electrification opportunity. But, the real value lies in a fleet’s own data. Fleet operators have the ability to complete their own EV Suitability Assessment with Geotab to identify where it makes sense to electrify today.

To learn more visit the EVSA solution page.

Research assumptions:

- Vehicle evaluation from March 2019 to February 2020.

- Vehicle service life of eight years, in line with SMMT average ownership life.

- Vehicle segments split into three classes, cars, SUVs and Vans. Assessment performed on like-for-like ICE/EVs.

- Total cost of ownership factored in local fuel and electricity prices.

- Analysed on purchasing the vehicle outright, no leasing scenarios included.

- Assumed no daytime charging, if the vehicle daily distance was outside of the available range for more than 2% of trip days, a BEV was not recommended.

- Charging infrastructure costs not taken into consideration

About Geotab

Geotab is a global leader in connected vehicle and asset solutions, empowering fleet efficiency and management. We leverage advanced data analytics and AI to transform fleet performance, safety, and sustainability, reducing cost and driving efficiency. Backed by top data scientists and engineers, we serve over 55,000 global customers, processing 80 billion data points daily from more than 4.7 million vehicle subscriptions. Geotab is trusted by Fortune 500 organisations, mid-sized fleets, and the largest public sector fleets in the world, including the US Federal Government. Committed to data security and privacy, we hold FIPS 140-3 and FedRAMP authorisations. Our open platform, ecosystem of outstanding partners, and Marketplace deliver hundreds of fleet-ready third-party solutions. This year, we're celebrating 25 years of innovation. Learn more at www.geotab.com/uk, and follow us on LinkedIn or visit our blog.

© 2025 Geotab Inc.All Rights Reserved.

This white paper is intended to provide information and encourage discussion on topics of interest to the telematics community. Geotab is not providing technical, professional or legal advice through this white paper. While every effort has been made to ensure that the information in this white paper is timely and accurate, errors and omissions may occur, and the information presented here may become out-of-date with the passage of time.

Recent News

The Unseen Toll: Driver Stress and Road Safety

May 13, 2025

In the Driver’s Seat: Accelerating ROI Through Trusted Data Insights

July 12, 2024