Get fairer fleet’s insurance costs with Geotab telematics

Saving lives on the road and saving costs for fleet operators

Apr 15, 2024

Updated: Aug 28, 2024

Anyone who has ever been behind the wheel knows that driving can be dangerous.

Throughout 2023, there were more than 1,200 deaths on Australia’s roads, and about one in ten of them involved heavy vehicles. These are all shocking tragedies for the family and friends of those involved. Unfortunately, these devastating incidents also impose a significant cost on businesses through legal claims or, more often, rising insurance premiums for fleets.

Insurance costs have risen sharply in recent years due to high collision losses and the increased cost of repairs from supply chain difficulties with automotive parts. The time it takes to pick an insurance product has also increased, adding cost for fleet managers.

Companies are always looking for ways to be more cost-effective. A new type of insurance product – powered by telematics – might be the easiest way for fleet managers to tighten their belts.

Beyond cost management, businesses have a duty of care to ensure driver safety as the vehicle has legally been deemed a workplace. What if telematics data could assist you in getting fairer insurance premiums while making our roads safer for everyone?

Insurance premiums

Underwriting for fleets can be complex, factoring in vehicle specifications, usage patterns, driver history, and collision frequencies. Fleets with higher perceived risk incur heftier premiums, sometimes paying more than they should because they are assessed based on outdated or inconsistent data that fails to capture recent improvements.

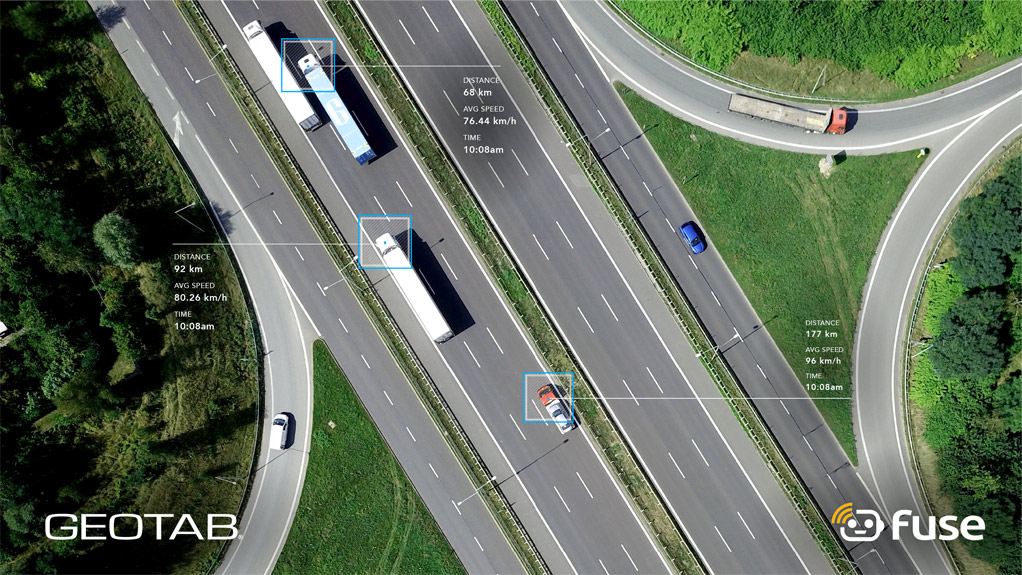

Geotab telematics enables rigorous and live tracking of vehicle health, location, and driver behaviour to paint a detailed and up-to-date picture of fleet operations. When these tools are accessible to insurers, they can evaluate the risk more accurately and reward well-managed fleets.

The same tools can also be leveraged to keep your divers safe. Unfortunately, 15% of drivers cause 50% of at-fault accidents. Telematics can help fleet managers identify drivers who are more likely to get into a collision so that fleet managers can offer more training and reduce the probability of a collision. The same tools can be used for vehicle maintenance scheduling.

The best insurance claim of all is the one you never need to make.

The story of 3 Sisters

One of our global clients, the small, Illinois-based trucking company 3 Sisters Logistics, slashed insurance premiums for their 35-vehicle fleet by a whopping 30%.

Despite drivers’ initial privacy concerns with the installation of Geotab GO and dashcams from Geotab Marketplace Partner Surfsight, they soon discovered that telematics helped to identify which drivers needed additional training and prove no-fault when it came to collisions on the road.

Over time, drivers and managers have gained confidence in telematics’ ability to protect their reputations and avoid liability for the company with video proof.

Geotab's partnership with Fuse Fleet Underwriting

Geotab’s partnership with Fuse Fleet Underwriting – part of the Australian Insurance Group. DKG Insurance Group – uses innovative AI-driven solutions to convert Geotab’s data into crash probability reports to help reduce accidents. For businesses already acting to encourage safe practices, it almost immediately lowers premiums.

By identifying and retraining the drivers who are most likely to get into a collision, fleet managers can improve road safety and continue to lower their premiums over time.

In addition, Fuse enables better, faster, and more cost-efficient claims with its fully digital claims management solutions.

Want to slash your fleet’s insurance premiums? Contact Geotab now to find the telematics solutions that meet your needs.

The MyGeotab and Technical Writing Teams write about MyGeotab updates for Geotab.

Related posts

.jpeg)

Geotab becomes a certified Telematics Monitoring Application Service Provider

April 1, 2025

3 minute read

From Rebates to Road Safety: A Guide to Optimising Your Council Fleet

March 24, 2025

1 minute read

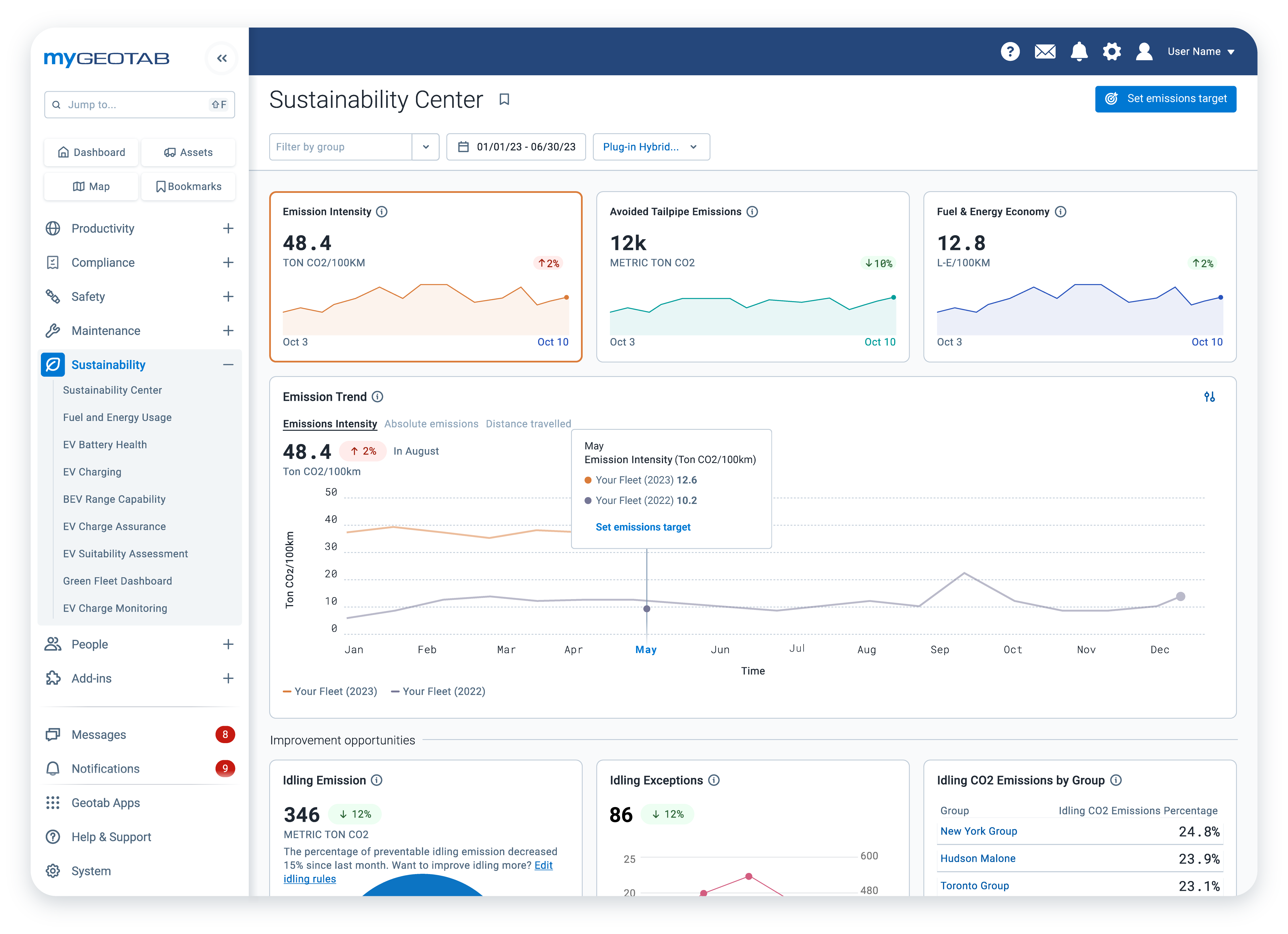

Sustainability Centre: central hub for sustainable fleet management

January 28, 2025

2 minute read

Geotab at MEGATRANS discusses Cost Savings and Automation

September 24, 2024

1 minute read

Electric vehicle sales double in Australia: here are three trends in EV adoption

September 8, 2024

2 minute read