Ireland’s EV Subsidies: Generous but not Limitless

What is the lesson ?

By Geotab

Jul 8, 2021

Updated: Oct 3, 2024

Motor industry giants like Volkswagen and Volvo are moving to scrap their diesel range by 2030, which in turn means that the national adoption of electric vehicles (EVs) is now more of an inevitability than a behavioral fad. This ideology can even be seen in the latest figures released by The Society of the Irish Motor Industry (SIMI). These stats denote that the number of newly-registered EVs is continuing to climb year on year in Ireland. While this is certainly a positive step towards reducing Ireland’s national carbon footprint, meaningful access to green vehicles is still hampered by the great EV caveat: purchase price.

To continue on an upward trajectory, both the Sustainable Energy Authority of Ireland (SEAI) and the Irish Government acted decisively on lowering the costly price tag of electrically-powered vehicles on Irish roads. The progressive actions undertaken by these authorities now mean that Ireland has ‘taken the wheel’ with some of the most generous supports in the world incentivising the purchase of EVs.

There has never been a greater package of subsidies instituted to assist buyers to flip the switch and change to electric. These include a €5,000 purchase grant, vehicle registration tax (VRT) relief, a toll incentive, a €600 home charger installation grant, as well as reduced motor tax rates. Comparatively, when it comes to the acquisition of EVs in other European jurisdictions, countries such as Belgium, Bulgaria, Cyprus, Denmark, Latvia, Lithuania, and Malta do not provide any purchase incentives. They merely grant tax deductions or exemptions for electric cars. Overall, 20 of the 27 EU member states offer incentives, such as bonus payments or premiums, to buyers of EVs. Benevolently, France is offering €12,000 in purchasing grants for EVs - the highest available subsidy in Europe.

In 2020, Ireland had a global EV market share of 7.4%, dwarfed by Norway’s leading 75%, but substantial compared to Estonia’s 0.2% at the bottom of the table. It can be said that much of our adoption thus far is due to the bountiful subsidies legislated here. For example, when observing Bulgaria’s mere 0.7% market share, with a national population one and a half times that of Ireland, we must wonder if this could be attributed to a lower rate of purchasing grants. Is there room for improvement of EV adoption within Ireland? Certainly. The Scandinavian countries show us this. But the wheels are definitely in motion and, in comparison to other countries with greater populations, Ireland is off to a steady start.

Of course, what’s important here is not who has more cash to flash, rather who will inevitably meet their greenhouse gas emission projections through the help of these stimulus schemes. Ultimately, Ireland is far from electrifying the projected target of almost 50% of the 2 million vehicles currently navigating the country roads, never mind aiming to do it in the next eight and a half years. With that said, greater democracy of and accessibility to electrically-powered vehicles will undoubtedly add to the plausibility of the overarching initiative of reducing carbon emissions, by increasing EV uptake that may otherwise remain below optimal levels.

These subsidies are the gateway to a greener future for all, but at what fiscal cost? When combining all available grants, rebates, and reductions, the average Irish EV purchaser can receive a direct state subsidy totalling €13,616. By way of these current supports, this would mean that every 100,000 new EVs purchased will cost the Exchequer upward of €1 billion, all the while leading to significant revenue decline in motor and fuel taxation. Achieving Ireland’s 2030 EV targets on time and feasibly is a difficult balancing act and one that careful consideration must be given to.

When we examine the national cost of these subsidies, it is clear that they are not indefinitely viable and will need to be cut and adjusted in the coming years. As of last month, the Department of Transport is already making progress towards this by reducing plug-in hybrid allowances from €5,000 to €2,500.

The lesson here is simply that consumers need to act now, whilst these state measures are still at their disposal. With technological advancements combating range anxiety, further investment in national charging infrastructure and a wider range of manufacturers to choose from, opting into a flashy, new EV has never been more appealing. However, we must reiterate that at such a mammoth cost to the Exchequer, and much like the fossil fuels they seek to replace, these delightful allowances for battery-powered vehicles won't be around forever.

Subscribe to the Geotab Blog

Geotab

Subscribe to the Geotab Blog

Related posts

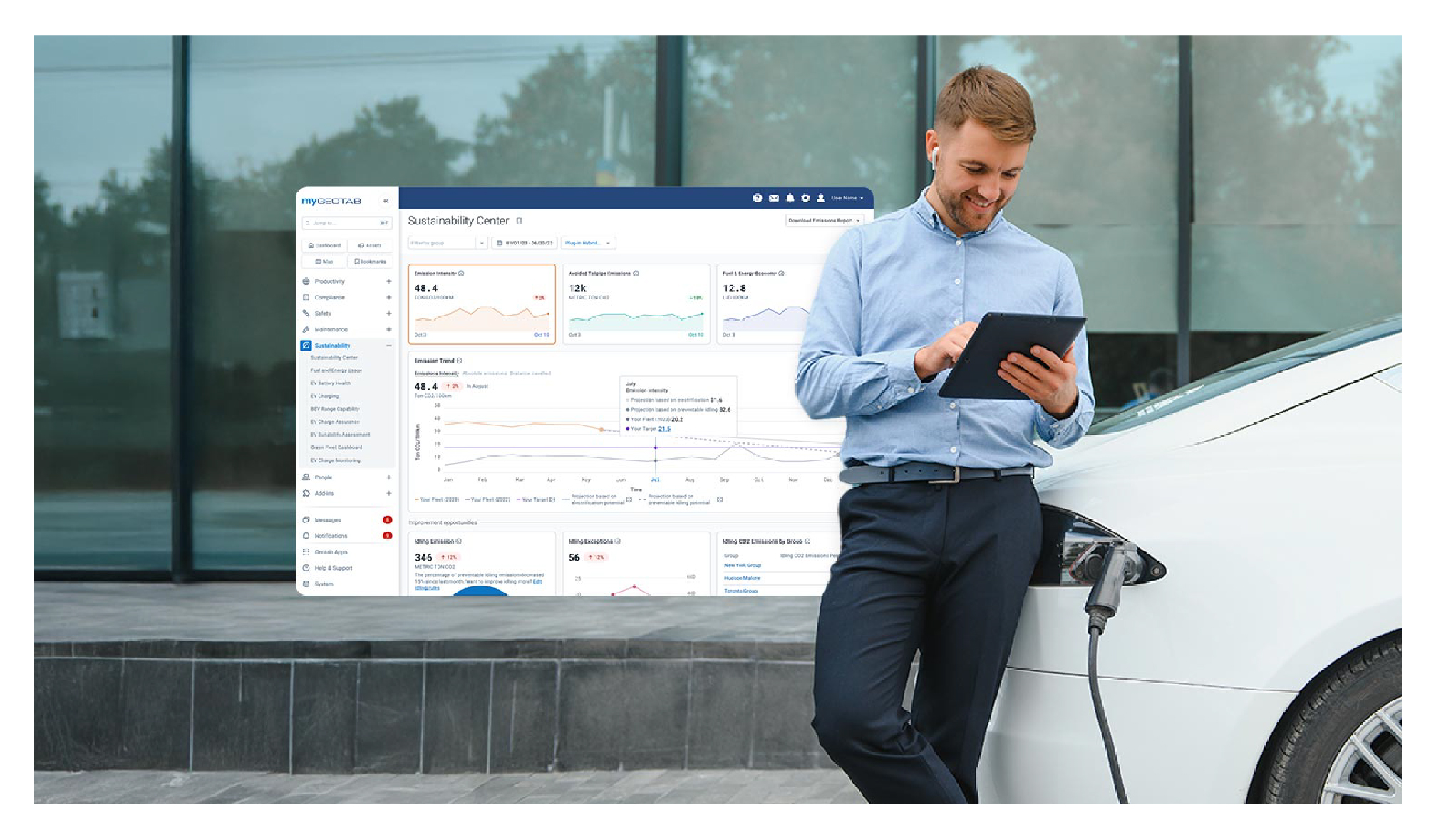

Geotab’s new fleet Sustainability Center simplifies fuel and emissions reduction

June 13, 2025

3 minute read

.jpg)

Lead with Trust: How Geotab Helps Businesses Navigate CSRD Compliance

March 19, 2025

2 minute read

2030 or 2035, the UK Needs Meaningful Action on EVs Now

September 6, 2024

2 minute read

Driving smarter: Insights from Geotab’s “Taking Charge” Report

August 8, 2024

2 minute read

The art of the possible: Insights from Geotab’s “Taking Charge” Report

June 20, 2024

3 minute read