Profitable sustainability: The potential of European fleet electrification

Table of contents

- Executive summary

- Introduction

- Assessing European fleet electrification potential

- What is an EV Suitability Assessment (EVSA)?

- 59% of analysed fleet vehicles could economically go electric today

- Today's EVs can meet most range requirements

- Making the economic case for fleet electrification

- A quick note on defining economical

- Regional driving patterns can affect EV viability

- The impact of incentives on electrification

- Even a small rebate can make a big difference

- Impact of existing rebates at a regional level

- Creating more sustainable fleets in Europe

- Reduced vehicle exhaust emissions from electrification

- Fleet electrification: next steps

- Understanding where to go electric

- Operating electric

- Sustainable best practices for an existing fleet

- Conclusion

- There is enormous potential for fleet electrification in Europe

- Methodology and assumptions

- About Geotab

Executive summary

With all eyes set on reducing carbon emissions, there has never been a better time to consider fleet electrification. This study analysed real-world data from over 46,000 passenger and light-duty commercial vehicles in 1,300 fleets across 17 European countries — including Germany, France, Spain and the UK.

Study highlights:

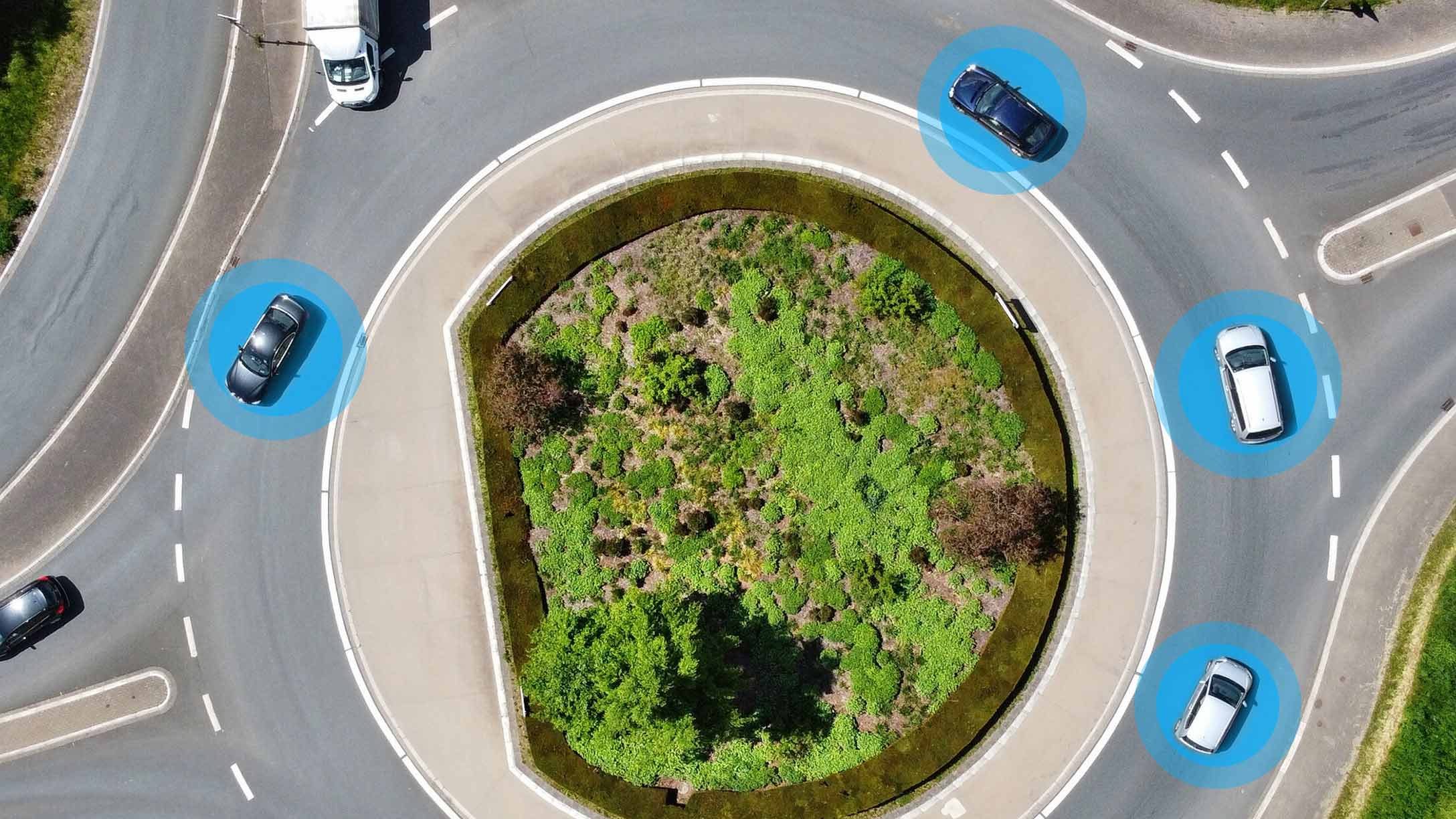

- 86% of the analysed vehicles could be replaced with a range-capable battery electric vehicle today

- Nearly 60% of fleets could save money by transitioning to electric vehicles

- European fleets that were analysed could save a total of £218M and over 156,000 tonnes of CO2 over the next seven years

With the increasing number of emission targets and mandates being implemented, organisations will need to start exploring adding electric vehicles to their fleets. Fortunately, the data shows that becoming more sustainable can also be profitable. This study will explore the benefits of fleet electrification, how today's EVs can meet the demands for most fleet applications, the impact government incentives have on EV adoption and lessons fleets can learn to improve their business.

Introduction

Around the world, governments and organisations are looking for ways to become more sustainable in an effort to address climate change. One of the areas gaining the most attention is the transportation sector, which is one of the largest sources of GHG emissions. This has resulted in a number of countries implementing a variety of regulations and emissions targets. This includes a ban on the sale of new internal combustion engine (ICE) cars in the UK by 2030 and a similar proposal from the EU by 2035. As these dates are quickly approaching, organisations need to understand the impact of having electric vehicles in their fleets within the next two or three lifecycle replacements.

Assessing European fleet electrification potential

In order to understand the potential of fleet electrification in Europe, Geotab conducted a study that analysed trip data from 46,000 European passenger and light-duty commercial vehicles over the course of one year (30 December 2020–30 December 2021). Using our EV Suitability Assessment (EVSA) tool we were able to determine how many of these ICE vehicles could be switched out with EVs that are on the market today. Some considerations included whether an EV had the range capability to handle the existing vehicle's daily driving needs and whether it made economic sense for a fleet to make the switch.

Although there are differences across countries, which will be explored throughout this paper, the overall results show that there is enormous potential for light-duty fleet electrification across Europe. Not only would fleets avoid producing a significant amount of CO2 emissions, a majority of them could actually become more profitable, with the replacement EVs offering a lower total cost of ownership (TCO).

Note: This study focuses on fully electric battery electric vehicles (BEVs) and does not include plug-in hybrid electric vehicles (PHEVs). The vehicles included in this study are passenger cars and vans. See the methodology section at the end of this document for more details.

What is an EV Suitability Assessment (EVSA)?

Geotab's EVSA tool uses telematics data to understand a fleet's specific needs and makes EV adoption recommendations. It measures real-world EV performance metrics, financial savings and environmental benefits to help fleets electrify with confidence. It starts by answering a few questions:

Which vehicles can be transitioned?

Determine if there is an EV with enough range to meet the fleet's daily driving requirements.

Does it make economic sense to go electric?

Examine a vehicle's TCO compared to an equivalent ICE vehicle, including fuel and

maintenance costs, to determine if the fleet would save money by switching to an EV.

What are the environmental benefits of electrification?

Quantify the amount of exhaust CO2 emissions that can be avoided by moving away from

ICE vehicles.

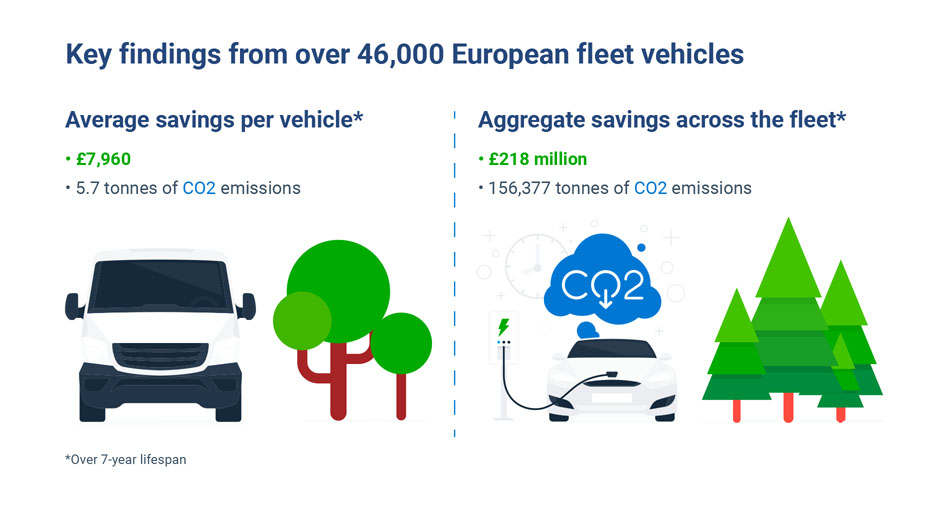

59% of analysed fleet vehicles could economically go electric today

There are two determining factors when considering EV suitability: Is there a range-capable EV that can meet the daily driving requirements, and does it make economic sense to make the switch?

Today's EVs can meet most range requirements

Our analysis found that 86% of the 46,000 vehicles had a range-capable replacement that would satisfy 98% or more of the trips taken that year. This means that with all of the improvements in battery electric vehicle technology over the last few years, current BEV models had enough range to handle the daily route without having to charge mid-way through the duty cycle. We allowed for up to 2% outlier trips, to exclude any abnormal driving distance days that might occur outside of standard usage.

This study did not include plug-in hybrid electric vehicles (PHEVs) and as such the previously mentioned statistics apply solely to battery electric vehicles. Sales trends show that PHEVs account for a declining portion of overall EV sales. However, PHEVs may be an interim solution for fleets as they begin electrifying. Since PHEVs have the ability to also run off petrol, range capability is irrelevant for their use. For the 14% of vehicles that currently cannot be replaced by a range-capable BEV, a PHEV alternative may be an option. The trade-off is that they do not benefit as much from the reduced fuel and maintenance costs. Fleets can use tools like Geotab's EVSA to determine which vehicle type is most appropriate for their current needs.

Making the economic case for fleet electrification

The argument for EV adoption is often seen primarily as an environmental issue — it is a way to reduce CO2 emissions. However, this study shows that there are strong economic reasons for a fleet to go electric. Even with a higher acquisition cost, EVs typically have a lower TCO. This is a result of EVs having lower energy and maintenance costs over their lifespan.

We found that 59% of the analysed vehicles can economically be replaced with an equivalent EV and that on average a fleet would save £7,960 per vehicle over a seven-year lifespan. This includes saving an average of £5,152 per vehicle on fuel alone.

This part of our analysis does not take into consideration any financial incentives or rebates. When you include a rebate that reduces the upfront purchase price, even more vehicles become economically viable. This topic will be explored later in this paper.

If all of the economically viable vehicles in this study were electrified, it would represent over £218M in savings over the next seven years.

A quick note on defining economical

For this assessment, we considered a vehicle economically suitable for replacement if the total cost of ownership—composed of procurement, maintenance cost and fuel savings—for the EV was equal or less than a new ICE vehicle replacement.

Regional driving patterns can affect EV viability

Variations in EV suitability can be seen for each country due to differences in usage and local prices.

For example, 89% of the vehicles in the UK were considered range-capable, but EV suitability was reduced to 55% when economic viability was included. Compare this to Germany, where 77% met range requirements with 69% being economical. Leaders in terms of economic viability were Italy, Spain and Germany, with the Netherlands, France and the UK at the bottom end.

One of the main reasons for the lower economic viability appears to be tied to utilisation. On average, the vehicles in the UK and France drove the fewest miles annually. This means that those vehicles will not have had the same fuel cost saving opportunities from going electric, which accounts for 65% of the total cost savings over the lifespan of a vehicle.

The impact of incentives on electrification

Currently, EVs have a higher acquisition cost than their ICE counterparts. This is changing as the cost of battery technology, the most expensive component of an EV, has dropped significantly over time. According to BloombergNEF, in 2021 lithium-ion battery pack prices fell to £105 per kWh, down from £948 per kWh in 2010. While recent setbacks with global supply chain shortages may not see price parity for another several years, over time the upfront cost of EVs is expected to continue to drop.

Even a small rebate can make a big difference

In an effort to accelerate EV adoption, many governments have implemented incentive programmes. Some are targeted towards building out charging infrastructure, while others aim to reduce the acquisition cost of the vehicles themselves. These rebates can play a significant role in making electrification more viable and lowering the overall total cost of ownership.

When looking at Europe as a whole, on average a £3,349 (€4,000) rebate would increase the economic viability by an additional 6 percentage points, and a £5,442 (€6,500) rebate would increase it further to 9 percentage points. This goes to show that rebates are important levers for governments to help incentivise businesses to go electric until EVs achieve price parity with ICE vehicles. Rebates significantly help increase the use cases for going electric and help companies realise a positive ROI sooner.

Impact of existing rebates at a regional level

The range of rebate support varies greatly from one country to the next. Some governments are providing significant cash incentives, while others do not provide any at all.

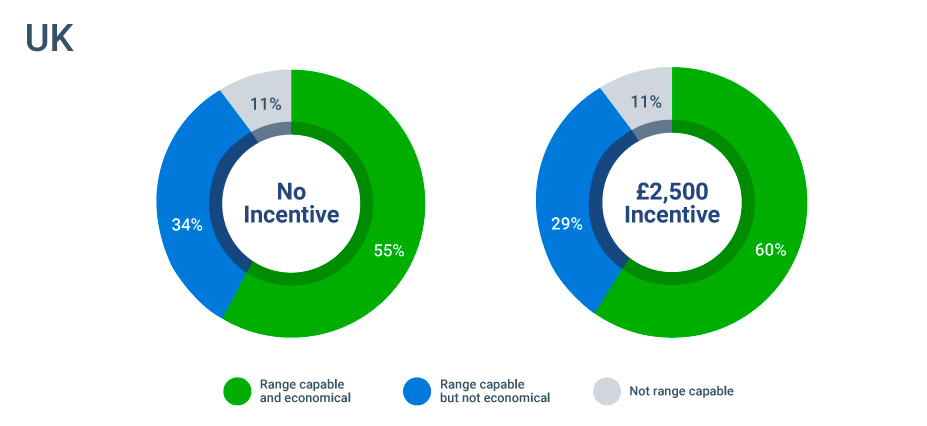

To illustrate the variations a rebate will have, we can compare two different countries: Germany and the UK. Of the countries included in this study, Germany has one of the largest incentives available to fleets and the UK has one of the smallest. However, our study shows that only 8% of the German fleet would lose money when replacing their ICE vehicles with a range-capable BEV — even before rebates are applied. On the other hand, in the UK a larger portion would be range-capable, but 34% would not be economical.

Our study found that in Germany 69% of the vehicles were both range-capable and economical, without applying any incentives. If you include a £7,537 (€9,000) rebate, which is currently the largest rebate offered on some BEVs, that number increases to 73%.

For the UK, the potential impact of a rebate is even greater. Comparatively, they offered a smaller £2,500 rebate on some BEVs, but this still increased the number of vehicles that were both range-capable and economical to 60%, up from 55%.

Creating more sustainable fleets in Europe

Europe is taking a leadership role in combating climate change with a number of bold initiatives. For example, the European Union's Fit for 55 initiative aims to reduce net greenhouse gas (GHG) emissions by at least 55% by 2030, and sets targets for 100% of cars and vans to be zero-emission vehicles by 2035. The UK has created similarly aggressive targets with their sixth Carbon Budget and previously mentioned ICE vehicle sales ban. This essentially means that all light-duty ICE fleet vehicles will need to be transitioned to an EV over the next two or three lifecycle replacements. In an effort to ensure that the 2030 target is met, the UK Government recently published the outcome of a consultation looking at what regulatory framework could be implemented to further support transport decarbonisation. An area of particular interest to the industry was a proposition to stagger mandated proportions of vehicle sales to be zero-emissions over the next eight years.

Reduced vehicle exhaust emissions from electrification

When considering the environmental impact of electrification, there are two main factors: average lifetime emissions and exhaust emissions. Lifetime emissions incorporate any emissions during both the production of the vehicle and the generation of electricity used to power it. This is outside the scope of this study, but there is other research that shows that even if electricity is generated through a CO2-intensive source, such as coal, EVs still produce less carbon emissions than an ICE vehicle.

Our analysis focuses on exhaust emissions and measures the amount of CO2 emissions avoided by using an EV instead of an ICE vehicle. The data shows that on average a fleet would avoid at least 5.7 tonnes of CO2 emissions per vehicle over their lifespan. Even if only the cost-effective vehicles in this study were electrified, this would represent over 156,000 tonnes of CO2 — the equivalent of carbon sequestered by 2.6 million tree seedlings grown over 10 years.

Fleet electrification: next steps

The key to building out an effective electrification blueprint and creating a more efficient fleet is making informed decisions by reviewing vehicle data.

Understanding where to go electric

There are a number of things to consider when adding EVs to a fleet. For example, a solid understanding of the current vehicles' duty cycles and dwell times is required. During this study we determined whether an EV was range-capable based upon its ability to complete daily driving requirements without charging during the day. If there are ICE vehicles that are unassigned for long periods of time, fleets can increase the total number of vehicles suitable for electrification by having them charge when not in use, rather than relying only on overnight charging.

Another consideration is fleet utilisation. Vehicles that are currently underutilised may not travel enough to make a 1:1 transition to EVs economically viable. By right-sizing the fleet, it is possible to get enough mileage a year to justify electrification.

Fleet operators should keep their eyes open for government cash incentives, grants and tax exemptions. These can help create more use cases for EVs or reach a positive ROI sooner, as evidenced by this study. In addition to vehicle-based incentives, charging infrastructure incentives also exist.

Operating electric

Whether a fleet has already transitioned to EVs or if they are just being researched, fleet managers should know that going electric is only the beginning. Once they have incorporated EVs into their fleet they can take further steps to ensure that they are getting the maximum return on investment.

They should monitor charging data to make sure that EVs are fully charged for their next duty cycle in order to avoid unplanned downtime. They may also want to investigate if they can charge their vehicles during "off-peak" hours, when electricity is commonly less expensive and less carbon-intense.

Driver training is also important as there are additional steps operators can take to improve EV efficiency. One example of this is to have the vehicle pre-condition in warmer or cooler weather while it is still plugged in, to avoid using any additional energy from the battery.

Sustainable best practices for an existing fleet

Large-scale studies like this one provide an overview of what is possible by uncovering the macro trends of fleet electrification, but the real value comes from a fleet's individual data. By conducting their own EV Suitability Assessment, fleet managers can better understand the actual potential for their fleet. It takes into consideration nuanced information, like daily driving patterns, localised fuel costs and vehicle model availability, to provide customised recommendations. Creating an electrification blueprint is the first step to electrifying with confidence and achieving profitable sustainability.

Transitioning to electric vehicles is not the only way to reduce a fleet's carbon emissions. There are many best practices, powered by data-driven insights, that fleet managers can use to make their entire fleet more sustainable. Fleet right-sizing, route optimisation and idling time reduction provide some of the biggest opportunities to reduce carbon emissions from fleet operations, while also reducing costs.

Conclusion

There is enormous potential for fleet electrification in Europe

As nations across the world continue to work towards creating a more sustainable future, we will see a large increase in EV adoption. European countries have been some of the earliest adopters, but there is still lots of room to grow.

Since the transportation sector is one of the largest contributors of CO2 emissions, fleet electrification represents a way to significantly reduce an organisation's carbon footprint. By simultaneously reaping the economic benefits of EVs, fleets can remain competitive while working towards their sustainability targets.

Studies like this help highlight the opportunities that exist at an aggregate level and provide insights that help clarify and demystify fleet electrification. As fleets look to transition their operations towards more sustainable practices, including EVs, it is critical to review fleet-specific data to ensure that the fleet's needs and objectives are met.

Methodology and assumptions

This study utilised Geotab's EVSA for an aggregate, de-identified analysis of fleet vehicle driving patterns from 30 December 2020 to 30 December 2021 across Europe. The 17 European countries included were: Albania, Austria, Belgium, Denmark, France, Germany, Italy, Luxembourg, Poland, Portugal, Romania, Slovenia, Spain, Switzerland, the Netherlands, the Republic of Ireland and the United Kingdom. Country-level insights were provided for countries that had over 900 vehicles.

The study assumed that replacement vehicles were in service for seven years and were purchased, not leased.

EVs were considered range-capable if they could meet the vehicle's daily driving distance on a single charge for a minimum of 98% of the vehicle's trips that year. This allowed a 2% margin of error for any outlying trips that fell outside the norm.

For an EV to be considered economically viable it needed to be considered range-capable and have a total cost of ownership that was equal to or lower than that of a comparable new ICE vehicle replacement. Total cost of ownership includes the local cost of procurement and maintenance as well as the local November 2021 fuel and energy costs. Capital cost of infrastructure was not included.

Emissions calculations are based on the emissions factor of 2.29 kg of CO2 per litre of petrol. Comparing the aggregate reduction of 156,377 metric tonnes of CO2 across all vehicles to the equivalent amount of carbon sequestered by tree seedlings is based on the U.S. EPA online calculator.

About Geotab

Geotab is a global leader of connected vehicle telematics who is committed to making real progress towards climate action goals. We reveal insights from real-world data that helps fleets reduce emissions and costs while improving operational efficiency. This helps our customers implement effective carbon reduction strategies so that they can remain focused on their business.

Post Tags

About Geotab

Geotab is a global leader in connected vehicle and asset solutions, empowering fleet efficiency and management. We leverage advanced data analytics and AI to transform fleet performance, safety, and sustainability, reducing cost and driving efficiency. Backed by top data scientists and engineers, we serve over 55,000 global customers, processing 80 billion data points daily from more than 4.7 million vehicle subscriptions. Geotab is trusted by Fortune 500 organisations, mid-sized fleets, and the largest public sector fleets in the world, including the US Federal Government. Committed to data security and privacy, we hold FIPS 140-3 and FedRAMP authorisations. Our open platform, ecosystem of outstanding partners, and Marketplace deliver hundreds of fleet-ready third-party solutions. This year, we're celebrating 25 years of innovation. Learn more at www.geotab.com/uk, and follow us on LinkedIn or visit our blog.

© 2025 Geotab Inc.All Rights Reserved.

This white paper is intended to provide information and encourage discussion on topics of interest to the telematics community. Geotab is not providing technical, professional or legal advice through this white paper. While every effort has been made to ensure that the information in this white paper is timely and accurate, errors and omissions may occur, and the information presented here may become out-of-date with the passage of time.

Recent News

How to win the intermediary space

July 12, 2021

The Unseen Toll: Driver Stress and Road Safety

May 13, 2025

In the Driver’s Seat: Accelerating ROI Through Trusted Data Insights

July 12, 2024