Driver behavior monitoring systems: Fleet managers’ guide for top tools + implementation tips

Discover how advanced driver behavior monitoring systems can empower you to enhance safety, reduce costs and improve efficiency through real-time data insights and targeted driver coaching.

Key Insights

- Driver behavior monitoring is the continuous process of collecting and analyzing telematics and sensor data to assess how drivers operate their vehicles.

- It directly impacts fleet safety and efficiency by reducing risky behaviors, leading to fewer accidents, lower maintenance costs and improved fuel efficiency.

- A comprehensive driver management system like Geotab lets you implement real-time fleet driver monitoring and targeted coaching.

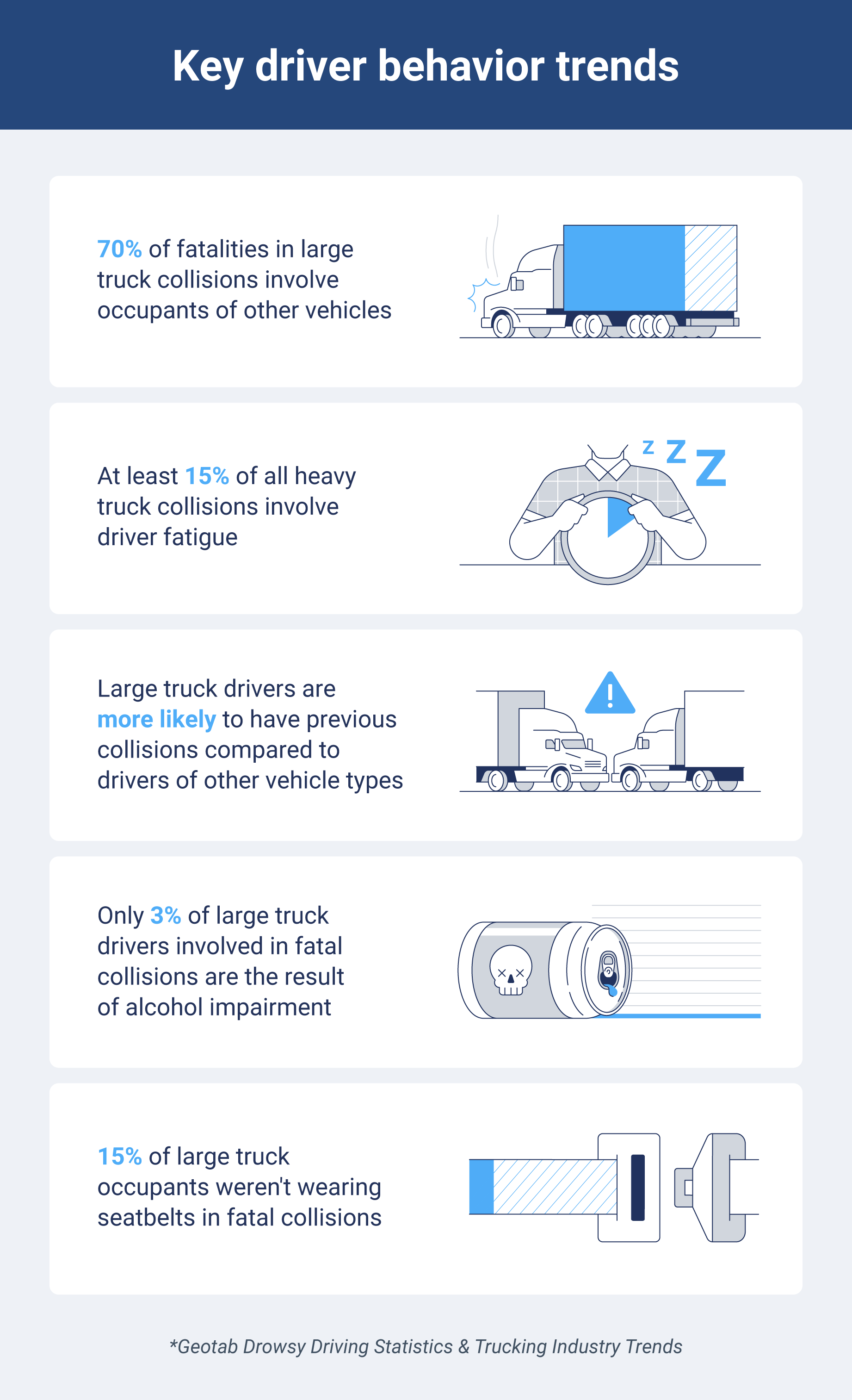

Driver behavior monitoring is essential for optimizing fleet efficiency and safety. For example, a driver management system that integrates real-time telematics with advanced analytics can quickly detect risky behaviors, such as drowsy driving, which the NHTSA estimates is a factor in 91,000 crashes annually.

Explore the 10 best fleet driver monitoring tools that help you continuously track and analyze driver performance. We will also share some tips you can use to further streamline and enhance your existing driver behavior monitoring techniques.

What is driver behavior data?

Driver behavior data is the collection of real-time metrics that capture how a driver operates a vehicle. It includes quantifiable information such as acceleration, braking, cornering and speed, all gathered through telematics and in-vehicle sensors.

Key driver behavior data points include:

- Speeding incidents

- Harsh braking events

- Rapid acceleration

- Sharp cornering or swerving

- Excessive idling

- Seat belt usage

This data is pivotal in driver behavior monitoring, providing insights into driving habits that can influence safety and performance. You can also use this data to identify and mitigate risky driving practices, optimize route planning and reduce operational costs — all of which contribute to effective fleet management.

What is a driver behavior monitoring system?

A driver behavior monitoring system is a technology-driven solution that continuously tracks and analyzes how drivers operate their vehicles. By using vehicle telematics, GPS and various in-vehicle sensors, the system collects data on driving actions — speed, acceleration, braking and cornering — to provide real-time insights into driver performance.

This helps identify risky driving behaviors, enhance safety protocols and improve overall fleet efficiency. Key features of a driver behavior tracking system include:

- Real-time tracking of speed, acceleration and braking events

- Alerts and notifications for harsh driving incidents

- Detailed driver performance reports and scorecards

- Integration with broader fleet management platforms

- Customizable thresholds for various driving behaviors

Best driver behavior monitoring systems

Monitoring driver behavior gives you the real-time data you need to improve driver behavior, enhance fleet safety, reduce risks and boost operational efficiency. You can access these benefits through behavior monitoring solutions that combine in-cab video capture with advanced telematics.

Tool Name | Key feature(s) |

| FleetCam Essential Road & Driver | Event-triggered video recording In-cab & road capture |

| GoAnalytics | Customizable dashboards Detailed historical reporting and trend analysis |

| FleetCam Pro Road & Driver | High-definition video capture Intelligent event detection |

| DV6 AI-Powered Recording | Dual-camera continuous recording AI-powered alerts and in-cab notifications |

| Mentor TSP | Integration of telematics and smartphone sensor data for driver risk management |

| ZenduONE - Camera | Event-triggered recording AI-powered face matching for driver identification |

| Predictive Coach | Automated, behavior-based coaching Targeted training modules based on real-time data |

| SpeedGauge Safety Center® | Real-time safety alerts Comprehensive driver safety scorecards |

| Drivewyze Safety+ | Real-time incident detection Automated coaching recommendations |

| SureCam | High-definition, event-triggered video capture Cloud-based storage with seamless Geotab integration |

1. FleetCam Essential Road & Driver

FleetCam Essential Road & Driver is a comprehensive dashcam solution that integrates seamlessly with your fleet's telematics system. It captures critical in-cab and road events, providing actionable insights to improve driver performance and safety.

Key features:

- Intelligent, event-triggered video recording

- Real-time alerts and driver behavior analytics

- Seamless integration with Geotab telematics platforms

- Secure cloud-based video storage and evidence management

- Customizable settings for proactive driver coaching

2. GoAnalytics

GoAnalytics is a robust analytics solution that empowers fleet managers to transform telematics data into actionable insights. Aggregating data across your entire fleet helps uncover trends and identify key performance issues such as excessive idling, harsh braking or fuel inefficiencies.

With GoAnalytics, you can gain a comprehensive view of your fleet’s operations that helps make better data-driven decisions.

Key features:

- Customizable dashboards for real-time monitoring

- Detailed historical reporting and trend analysis

- Automated benchmarking of fleet and driver performance

- Seamless integration with Geotab telematics data

- Alerts and notifications for critical performance metrics

3. FleetCam Pro Road & Driver

FleetCam Pro Road & Driver is an advanced in-cab and road video solution that delivers high-definition footage and robust event detection to help you monitor driver behavior effectively. Integrated with Geotab telematics, it records critical driving events and provides real-time alerts and detailed analytics.

This solution is ideal for fleets seeking to improve driver safety, optimize operations and maintain secure evidence management for incidents and training purposes.

Key features:

- High-definition video capture for both in-cab and road views

- Intelligent event detection with automatic recording triggers

- Real-time alerts and notifications for critical incidents

- Secure cloud-based storage for video evidence

- Customizable reporting and driver behavior analytics

4. DV6 AI-Powered Recording

DV6 AI-Powered Recording is an advanced, dual-camera HD recorder that continuously captures both in-cab and road footage while integrating seamlessly with any Geotab GO tracking device.

Powered by artificial intelligence, the system processes full HD video in real time and stores footage locally as well as in the cloud. It automatically triggers a 20-second clip upon detecting risky driving behaviors, allowing you to review critical events through the RoscoLive cloud platform integrated into MyGeotab.

Key features:

- Full HD video capture with real-time processing

- Local and cloud storage options with automated first-in, first-out management

- In-cab alerts for detecting risky behaviors such as drowsiness and distraction

- Easy filtering and review of video clips by date, vehicle and driver

5. Mentor TSP

Mentor TSP transforms your existing Geotab fleet management solution by integrating with eDriving’s patented Virtual Risk Manager® platform. This comprehensive driver risk management solution collects and analyzes data from smartphone sensors to monitor critical driving behaviors to provide a holistic view of driver risk.

By combining telematics insights with historical incident, collision and license violation data, Mentor TSP helps you identify high-risk drivers and reduce overall fleet costs.

Key features:

- Continuous monitoring and scoring of key driving behaviors

- Validated FICO® Safe Driving Score for consistent risk assessment

- In-app micro-learning and gamification for driver coaching

- Comprehensive analytics combining telematics, incident history and MVR data

- Advanced management coaching toolkit for high-risk drivers

6. ZenduONE — Camera

ZenduONE—Camera by ZenduIT is a comprehensive fleet camera solution that enhances fleet safety and operational oversight. It is designed to deliver advanced, real-time insights and combines AI-powered face matching with live video streaming and event-triggered recording.

This system captures critical in-cab and road footage during key driving events and supports interactive coaching workflows to help improve driver performance and accountability.

Key features:

- Event-triggered video recording integrated with telematics data

- Live video streaming with Geotab map integration for real-time situational awareness

- Interactive coaching workflows for targeted driver improvement

- Integrated asset tracking and Wi-Fi hotspot functionality for enhanced operational efficiency

7. Predictive Coach

Predictive Coach is a cutting-edge driver training solution that leverages Geotab’s telematics data to deliver behavior-based, real-time coaching tailored to each driver’s performance.

The system automatically assigns targeted training modules to address specific issues by analyzing data on risky driving behaviors. This process helps improve driver performance and enhance fleet safety.

Seamlessly integrated with the Geotab platform, Predictive Coach provides you with comprehensive reports and actionable insights to drive proactive risk reduction.

Key features:

- Automated, data-driven coaching that targets risky driving behaviors in real time

- Behavior-based training modules tailored to address specific safety issues such as distracted driving, speeding and harsh braking

- Flexible, on-demand training access for continuous driver improvement

- Proven risk reduction that significantly lowers fleet risk and operational costs

8. SpeedGauge Safety Center®

SpeedGauge Safety Center® is a comprehensive fleet safety solution that enhances operational oversight through real-time safety analytics and proactive risk management. Designed to seamlessly integrate with the Geotab platform, it centralizes driver behavior data, empowering you to quickly identify and address risky driving events.

SpeedGauge also provides detailed safety scorecards and customizable alerts — and supports targeted driver coaching to reduce incidents and improve overall fleet performance.

Key features:

- Real-time safety alerts and incident notifications integrated with telematics data

- Comprehensive driver behavior monitoring and safety scorecards for performance tracking

- Customizable dashboards and reporting for proactive risk management

- Automated incident reporting with actionable, data-driven insights

9. Drivewyze Safety+

Drivewyze Safety+ is an innovative fleet safety solution that provides real-time monitoring and actionable insights. It uses advanced telematics data — integrated seamlessly with the Geotab platform — to identify risky driving behaviors. It then sends immediate alerts, enabling swift intervention and targeted coaching for driver improvement.

With Drivewyze, you can detect and report critical safety events while getting comprehensive performance analytics that drive continuous safety enhancements across the fleet.

Key features:

- Real-time incident detection and alerts

- Customizable safety scorecards with detailed performance metrics for each driver

- Automated coaching recommendations based on observed risky behaviors

- Data-driven insights to continuously improve fleet safety

10. SureCam

SureCam is a fleet camera solution designed to enhance driver safety and streamline incident management. It captures high-definition video footage of both in-cab and road events, correlating critical driving data with recorded visuals. This enables you to monitor driver behavior, quickly respond to incidents and implement targeted coaching for continuous improvement.

Key features:

- Event-triggered video capture integrated with telematics data

- Continuous high-definition recording for both in-cab and road views

- Real-time alerts and notifications for critical driving events

- Seamless integration with the Geotab platform for unified fleet management

- Cloud-based video storage with easy retrieval for incident review

Benefits of strategic driver behavior monitoring

By continuously tracking driver performance, driver behavior monitoring systems help identify risks, facilitate targeted training and ensure compliance, ultimately strengthening overall fleet safety and efficiency. Below are some of the key benefits of monitoring driver behavior.

Improve driver safety

Enhancing driver safety is a primary benefit of monitoring systems, as they help identify risky behaviors in real time and enable proactive interventions. This approach significantly improves fleet safety by reducing the likelihood of accidents and encouraging safer driving habits across the fleet.

Driver behavior monitoring can:

- Reduce collision incidents and near-misses

- Enhance driver alertness through real-time coaching and feedback

- Improve adherence to safety protocols and regulatory requirements

- Lower injury rates and liability claims

Reduce fleet costs

Driver behavior monitoring helps reduce fleet costs by addressing inefficient driving practices and minimizing risk factors that lead to expensive repairs and insurance claims. By promoting fuel-efficient driving and reducing wear and tear, these systems contribute to substantial savings over time and help you:

- Increase fuel efficiency through smoother acceleration and braking

- Lower vehicle maintenance and repair expenses due to reduced mechanical stress

- Reduce insurance premiums, accident-related costs and liability claims

- Streamline incident reporting that minimizes administrative overhead

Increase fleet efficiency

Monitoring driver behavior boosts fleet efficiency by ensuring drivers comply with company policies and regulatory requirements. With real-time actionable fleet data and analytics, you can optimize routes, schedule proactive maintenance and maintain consistent driver performance. In short, it helps:

- Improve compliance with regulatory and safety standards

- Enhance route optimization and on-time deliveries

- Streamline driver scheduling and performance management

- Reduce vehicle downtime through predictive maintenance alerts

How to improve driver behavior across your fleet

Improving driver behavior is key to enhancing overall fleet performance and safety. Implementing targeted strategies and leveraging data-driven insights helps foster a safe driving culture that reduces risks and improves operational efficiency.

Here are some of the best ways to improve driver behavior:

- Develop an effective fleet safety program: Establish comprehensive initiatives integrating driver coaching and prioritizing fleet safety.

- Use data to evaluate common driver behavior issues: Leverage driver scorecards to identify patterns and areas for improvement.

- Continuous training for driver safety: Implement regular defensive driving sessions to keep driver safety at the forefront.

- Gamify driver safety: Incorporate interactive, engaging methods to motivate drivers and sustain safe driving habits.

- Recognize and reward safe driving: Use driver incentive programs to acknowledge and encourage consistent, safe behavior.

Promote safe driver behaviors with Geotab

Notably, 29% of collisions occur within one minute of reaching the maximum speed, and 71% occur within the first 10 minutes, underscoring the need for continuous monitoring and rapid response.

But to track and optimize driver behavior effectively, you need comprehensive driver safety reporting software that provides real-time insights into high-risk driving moments. And that’s what we offer — along with advanced telematics.

We help you monitor driver behavior by pinpointing dangerous patterns early, such as when drivers hit their maximum speed, so you can avoid what can be avoided.

Subscribe to get industry tips and insights

Frequently Asked Questions

Driver behavior monitoring involves tracking and analyzing how drivers operate vehicles using telematics, sensors and video to identify risky behaviors and improve fleet safety.

Examples of driver behavior you should track include speeding, harsh braking, rapid acceleration, aggressive cornering, excessive idling and distracted driving.

You can track driver behavior by using telematics devices, GPS systems, accelerometers and in-cab cameras integrated with fleet management software.

A driver monitor system collects and analyzes driving data to detect risky behaviors, generate safety reports and provide actionable insights for driver coaching and performance improvements.

The Geotab Team write about company news.

Table of Contents

Subscribe to get industry tips and insights

Related posts

The fleet safety incentive program checklist for driver engagement that lasts

June 19, 2025

2 minute read

Building a self-sustaining school bus driver safety program with Geotab Vitality

June 13, 2025

7 minute read

55+ Surprising distracted driving statistics and facts for 2025

May 30, 2025

8 minute read

Driving the Future of Public Safety: My Experience at Axon Week 2025

May 21, 2025

2 minute read

The Weight on Our Roads: Prioritising Driver Wellbeing for a Safer Future

May 13, 2025

1 minute read