What is the total cost of ownership? How to calculate and lower TCO for your fleet

Understanding total cost of ownership helps fleet managers look beyond sticker prices to see the complete financial picture, from acquisition through resale. It also helps identify opportunities to reduce expenses incurred across a vehicle’s lifecycle.

By Laurie Sehl

Dec 23, 2025

Total cost of ownership (TCO) expenses are often one of the largest bills when it comes to fleet costs. Too many organizations focus only on the vehicle purchase price, but that upfront cost represents only a fraction of the actual expense. Total cost of ownership includes everything from initial acquisition to fuel, maintenance, insurance and eventual resale.

By understanding the complete picture, fleet managers can make informed decisions that improve ROI and lower their TCO.

What is total cost of ownership?

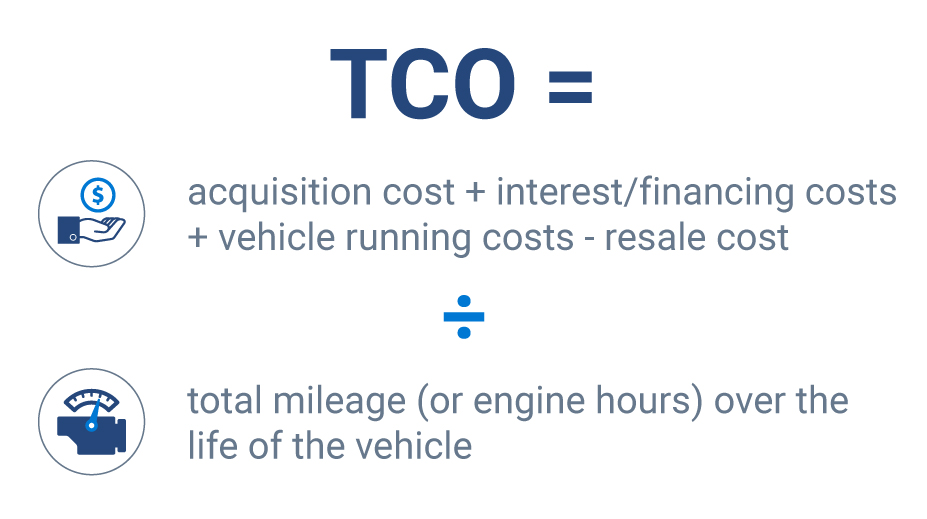

Total cost of ownership breaks down the true cost of operating vehicles over their lifetime. The TCO of a vehicle includes the initial cost of the vehicle, the return of funds when the vehicle is sold and all costs that come between buying and selling that vehicle.

TCO fleet management refers to the process of calculating and managing the total cost of ownership across your entire operation, taking into account how fuel, maintenance, downtime, driver behavior and administrative overhead compound across the fleet. Modern telematics platforms like Geotab provide the real-time data you need to monitor and optimize fleet-wide TCO factors.

Key components of TCO

Fleet managers who understand what drives total cost of ownership know how to address pricey areas to keep budgets reasonable. These are the key components you should pay attention to:

- Acquisition costs: These costs include the initial vehicle purchase or lease price, upfitting expenses, licensing fees and taxes. This upfront investment represents your single largest expense and can be offset by lowering operating costs over time.

- Financing costs: These costs include interest on loans and opportunity costs of capital tied up in vehicle purchases. What you pay here varies enormously depending on whether you buy or lease your vehicles.

- Fuel expenses: This is one of the highest ongoing costs for most fleets. Small improvements in fuel efficiency lead to compounded savings, especially for larger fleets.

- Maintenance and repairs: This includes proactive maintenance, unexpected repairs and parts and replacement labor costs. Fleet managers can lower these numbers with proactive maintenance to prevent costly breakdowns.

- Insurance premiums: Coverage costs vary by vehicle type, driver safety records, claims history and any risks specific to your fleet. Use telematics data to negotiate for a lower insurance premium and demonstrate clear fleet management ROI.

- Registration and compliance: This covers license plate renewals, vehicle inspection, regulatory compliance and administrative expenses.

- Telematics and fleet management technology: Enterprise-grade telematics devices and fleet management cost-per-vehicle technology is an investment that pays dividends through improved visibility, reduced fuel waste, lower maintenance costs and stronger asset utilization.

How to calculate TCO

Understanding the TCO definition is only half the battle. Figuring out how to calculate TCO? That is even more important.

To help you understand how to best calculate vehicle operating costs with the total cost of ownership formula, we have broken everything down into categories. Each category is summarized below with helpful tips for using Geotab’s tools and solutions to enhance data-driven decisions.

Vehicle acquisition costs

The more options added to the vehicle, the higher the cost. This is why it is important to consider the value of these added options to the business and the resale value of the vehicle.

Acquisition usually includes:

- The dealer’s selling price

- Manufacture concessions or incentives

- Vehicle upfitting costs (storage design, configuration, installation, etc.)

- Licensing

- Pre-delivery inspection

- Local taxes

- Environmental taxes

- Tank fill-ups

- Administration costs

Fleet financing costs

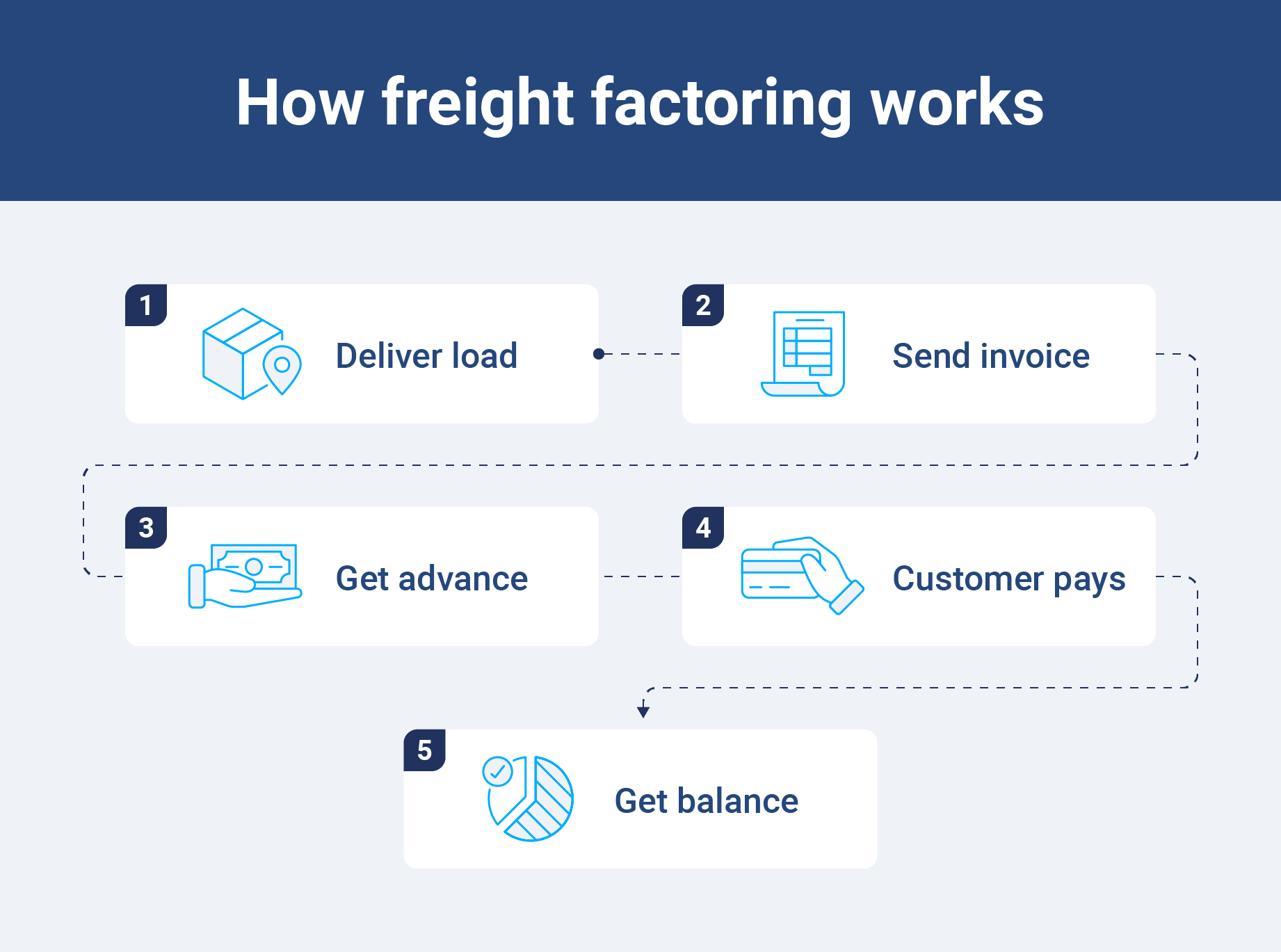

Whether the vehicle is leased or owned, there is a financial burden attached to the asset. This is an important cost to consider, and is the reason why many companies turn to freight factoring for help.

Some companies have a very low cost of capital and may decide to buy their own vehicles, while others like the advantages of leasing or borrowing. Either way, interest costs (or opportunity costs of ownership) and lease administration fees are important costs to consider.

Running costs

The costs of running a vehicle should not be overlooked. Vehicle upkeep and maintenance, as well as general day-to-day expenses, greatly contribute to your cost of ownership.

Running costs include:

- Fuel (gas or electric)

- Scheduled and unexpected maintenance repairs

- Vehicle insurance

- Plate renewals

- Insurance deductibles

- Vehicle repairs

- Car washes

- Tolls

- Tickets

Using a trucking cost per mile calculator provides more accurate data on each vehicle and your fleet as a whole.

Resale costs

When you decide to sell a fleet vehicle, there are generally two factors to consider:

- Which vehicle attracts the highest dollars at the time of resale

- The best mileage, age or time to replace the vehicle

That said, these factors are not mutually exclusive decisions. For this reason, resale value is sometimes not considered when selecting a vehicle. However, it is one of the biggest factors in calculating total cost of ownership.

It is worth consulting the market or accessing professional resale resources to gain a better understanding of the asset's value and the optimal time to replace it.

Why is calculating TCO important?

Total cost of ownership is a vital part of fleet management and is not something to be ignored. Calculating it correctly means more accuracy in your financial reporting and planning, and a better understanding of each vehicle’s performance in comparison to others in your fleet.

Choosing a reliable vehicle that meets the needs of the job at the lowest possible cost is essential to fleet success. With TCO insights, fleet managers can optimize replacement timing, improve budget accuracy, support telematics data in reducing costs, benchmark performance and increase fuel efficiency.

Example use cases of TCO in fleet management

Understanding how TCO applies in real-world scenarios can help fleet managers make stronger and more strategic decisions. Here are some common situations where total cost of ownership analysis drives better choices.

Electric vs. internal combustion engine (ICE) vehicles

TCO analysis matters for both ICE and electric vehicles, but it is especially valuable when evaluating EVs.

While EVs usually have higher upfront acquisition costs, the total cost of ownership often proves lower over the vehicle’s lifecycle due to lower fuel costs, reduced maintenance expenses, longer vehicle lifespan and potential federal incentives like rebates and tax credits.

However, TCO calculations must also account for investing in charging infrastructure, battery degradation and operational patterns since EVs work best on predictable routes.

Small vs. large fleet budgeting

Total cost of ownership scales differently depending on fleet size.

Small fleets (under 50 vehicles) should adjust their approach to TCO because they:

- Often lack dedicated fleet management staff, making simple TCO tracking essential

- May not have negotiating power for volume discounts on insurance or parts

- Should focus TCO efforts on the highest-impact cost categories like fuel and preventative maintenance

Large fleets (hundreds or thousands of vehicles), on the other hand, should focus on:

- Incremental TCO improvements that compound into substantial savings

- Investing in specialized TCO analysis tools and dedicated fleet management staff

- Leveraging better rates on financing, insurance and bulk purchasing

Using telematics to reduce TCO

Geotab’s telematics platform helps fleet managers calculate vehicle operating costs with greater accuracy. It can also identify opportunities to lower TCO with fuel optimization, maintenance cost reduction and asset usage by revealing which vehicles are underused.

How fleets can lower the total cost of ownership

Knowing your current TCO only helps if you act on the insights. Here are some practical strategies fleet managers can implement to lower their total cost of ownership.

Right-size the fleet:

- Identify and eliminate unused vehicles that drain resources.

- Match vehicle size and abilities to actual job requirements.

- Use telematics data to identify opportunities for vehicle savings.

Implement preventive maintenance programs:

- Schedule maintenance based on engine diagnostics and usage instead of arbitrary time intervals.

- Address small issues before they become costly repairs.

- Track maintenance costs per vehicle to address problematic assets.

Monitor and improve behavior:

- Coach drivers on fuel-efficient driving techniques like reduced idling and smooth braking.

- Use Driver Safety Scorecards to identify high-risk drivers who increase insurance premiums.

- Recognize and reward safe, efficient drivers to encourage positive behavior.

Optimize routes and operations:

- Use route optimization software to cut back on unnecessary mileage.

- Consolidate trips and eliminate inefficient routing patterns.

- Adjust deployment to match vehicle capabilities with actual operational needs.

Turn TCO insights into smarter fleet decisions

Calculating total cost of ownership gives fleet managers the full financial picture of vehicle investment. These numbers are necessary to optimize spend and operations, but the true value of TCO comes from acting on those insights.

Modern telematics platforms make TCO management practical by automating data collection and even reconstructing collision incidents to better understand prevention techniques. Fleet telematics for safety and efficiency shows how comprehensive data visibility takes fleet operations from reactive to proactive.

Ready to gain control over your fleet’s total cost of ownership? Geotab’s fleet safety solutions, like Geotab Drive, provide the foundation for understanding and reducing TCO with real-time monitoring, predictive maintenance and driver behavior insights.

Subscribe to get industry tips and insights

Frequently Asked Questions

The five most important elements of TCO for fleet vehicles are:

- Acquisition cost (purchase or lease price)

- Fuel expenses

- Maintenance and repair costs

- Insurance premiums

- Depreciation/resale value

Together, these represent the majority of lifecycle expenses for fleet vehicles.

Common TCO mistakes include:

- Focusing on only purchase price while ignoring lifecycle costs

- Failing to track maintenance and fuel consumption per vehicle

- Replacing vehicles too early or too late

- Not accounting for driver behavior

Failure to account for all of these factors can lead to poor vehicle selection and missed cost optimization opportunities.

Upfront cost is the initial purchase price or down payment required to acquire a vehicle. Total cost of ownership, or TCO, encompasses all of the expenses incurred throughout the vehicle’s lifecycle, from acquisition through disposal.

Laurie Sehl is Global Account Manager for Geotab.

Table of Contents

Subscribe to get industry tips and insights

Related posts

Building resilient school bus operations through four student transportation trends

February 24, 2026

6 minute read

How to stop wasting mechanic hours on ‘ghost codes’ and low-priority repairs

February 2, 2026

2 minute read

Telematics trends for 2026: What is changing and how fleets can respond

January 30, 2026

6 minute read

Fleet GPS tracking systems cost: Full price breakdown and ways to boost ROI

January 30, 2026

6 minute read

Fleet operations: Key components, benefits and challenges

January 7, 2026

4 minute read