-Hero@2x.jpg)

Mining value from connected vehicle data: How OEMs can lead the next-gen of data-enabled services

-Hero@2x.jpg)

Table of Contents

Effective strategies to leverage the value of data can be elusive. There’s a substantial opportunity to not only create new value streams with data-based services — especially inside the commercial fleet space — but to also strengthen end-user relationships by leveraging vast amounts of vehicle-generated data.

The $250-400 billion opportunity

According to the McKinsey article, “Unlocking the full life-cycle value from connected-car data,” connected car-data monetization could deliver between $250 billion to $400 billion in annual incremental value, revenues that no OEM can afford to ignore or be slow to exploit.

But automotive original equipment manufacturers (OEMs) need to overcome some hurdles before delivering a truly connected customer experience: better integration into the global mobility ecosystem, more seamless technology interfaces with less complexity and strategic partnerships with third-party companies (e.g. Telematics Services Providers (TSP) like Geotab) that leverage core competencies with specialized services.

Data-driven product offerings and recurring revenue streams may consider new business models to align internal departments and teams with a shift in mindset; a shift that moves them from single Point of Sale (POS) interactions (like one-time sales of a vehicle) to creating customer offerings across the entire lifecycle of the vehicle.

Such a shift will help OEMs build symbiotic relationships within the greater connected car ecosystem so they can launch new services at scale and ensure development budget and product-focused teams, such as research and development (R&D), are focused on core competencies and differentiating technologies.

The opportunity to capitalize on the value that data can provide is real and this paper will explore the strategies that auto manufacturers can deploy to create stronger customer offerings and take advantage of the overall connected car opportunity.

The mammoth opportunity of data monetization

It is no coincidence that seven of the 10 most valuable companies in the world are built on data-based services. Throughout the entire connected car value chain, companies from insurance providers to after-market suppliers are leveraging data to provide customers with enhanced, data-based services.

According to the Mckinsey report, “Forecasts indicate that connectivity levels will increase significantly, with 60 to 70 percent of new vehicles sold in North America and Europe reaching Connected Car Customer Experience (C3X) Level 3 or above by 2030”. This increase signifies an evolution in the connected car experience that reveals a new level of intelligent connectivity, and with it, a growing market for solutions that take advantage of the associated technology.

Specifically, commercial customers require key vehicle data to manage and optimize their fleets. For them, a fleet vehicle is a revenue-generating asset. By providing the right data from connected vehicles, OEMs can increase sales and achieve greater brand loyalty. In addition, a large percentage of businesses are already making their vehicle purchasing decisions based on the availability of vehicle data. According to the Mckinsey report, “about one-third of customers are willing to switch car brands to achieve better connectivity.”

The bottom line? Fleets are willing to pay for solutions that help them make better decisions and run their business more efficiently.

“Those that fail to act now will miss the opportunity to differentiate themselves in one of the industry’s key customer-facing spaces.” McKinsey & Company, February 2021

Building a seamless data environment

The nature of the connected car provides OEMs with a built-in opportunity for frequent and meaningful customer interactions. Similar to Google and Apple, who use customer data to enhance the experience of the connected home, OEMs have an opportunity to deliver similar experiences inside the connected car.

In reality, creating an optimal connected car experience is challenging and depends on a number of micro and macro factors.

From a micro perspective, issues like compatibility and interoperability (i.e. having all the individual parts of the connected car system work and communicate with each other), can reveal significant challenges when trying to build a seamless connected environment.

On a macro level, connecting each individual system to the global mobility framework inside a secure environment that supports data commercialization is something that can be a struggle to accomplish. There are several key reasons for this:

First, working strictly inside their own core competency. OEMs are experts at building and servicing cars. That laser focus can mean a slight divergence from the overall connected car ecosystem. This has resulted in missed opportunities to leverage partnerships with specialty vendors who can complement their core competencies and open up to new market opportunities. For example, building an in-house telematics solution with both hardware and software components, rather than partnering with a proven supplier means shifting resources away from core operations and splitting employee focus.

Next, slower to embrace customer data needs, which includes:

- Understanding needs. Commercial fleets, specifically, rely on data-driven insights to optimize fleet operations and productivity. Understanding the needs of these customers is crucial, as more purchasing decisions are based on the availability of data.

- Elevating design. Technology companies are experts at stripping away complexity to improve the customer experience. Today, complex sign-up and log-in processes, coupled with challenging interfaces for connected services, are opportunities for OEMs to work towards one-click solutions.

- Leveraging customer feedback. Customer feedback is invaluable for product improvements and innovation. A ‘customer obsessed’ corporate culture and infrastructure helps ensure a feedback loop between customer requests and feature releases with short reaction times.

The reality is that the connected car, and its associated technology, live on the cusp of innovation and development; the effective value creation of the data-enabled services borne of that innovation is ripe with opportunity.

OEMs who leverage the connected car ecosystem and understand the unique data needs of their customers will be in a better position to take advantage of those opportunities than those who remain in silos.

Furthermore, the lessons of data-based product offerings can be realized through better alignment with core competencies and a business model that supports life-cycle monetization.

Shifting mindsets: Building the right data model for fleet customers

According to an Automotive News article, some third-party companies are ahead of OEMs with regard to specific core competencies. For example, Geotab has been focused on telematics since 2000 with a proven record of success, including strong partnerships with OEMs such as Ford and GM.

The article suggests, “rather than compete directly, a better strategy (for OEMs) may be data licensing schemes that can bring more value to consumers in exchange for usage insights to drive sales, service, and marketing programs more intelligently.”

Data connectivity yields the chance to optimize nearly every aspect of a vehicle’s life cycle, from sales to after-sales business, through detailed customer insights. For this to occur, the right data-driven business models must be determined.

By shifting mindsets and operating in a business model that supports the connected car ecosystem through symbiotic relationships, OEMs are better-positioned to consider full life-cycle monetization. Forward-thinking OEMs are starting to realize this and are leveraging third party vendors to access bigger shares of the market and open more opportunities from connected vehicle data.

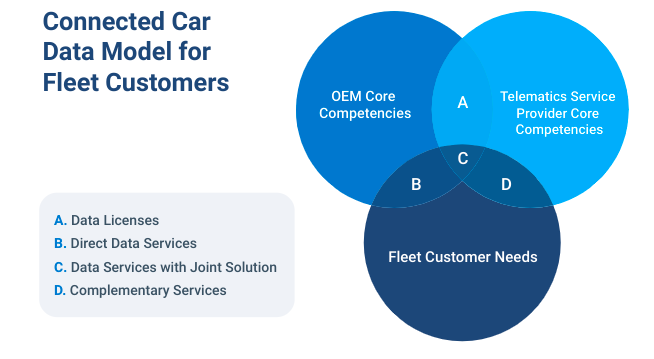

In the same Automotive News article, Motormindz presents their diagram for the connected car model. If we create a fleet-specific version, we can see the opportunities for OEMs who consider their B2B prospects and their unique needs.

Here’s what to consider for a fleet-specific data model:

- What OEMs do well

- What fleet customers need

- What third-party vendors do well

What OEMs do well

The first step for OEMs is to define their “build-versus-buy strategy” — i.e., where do they develop and build their own systems versus where to build strategic partnerships to augment their core competencies.

Of course, defining such a strategy depends on identifying differentiating key control points and specific core competencies. After OEMs have identified those points, they can determine where to leverage existing infrastructure, service, and data providers to build a partnership ecosystem. This will allow OEMs to quickly scale.

In the instance of remote-vehicle monitoring and services, this means partnering with experienced after-market telematics vendors.

What fleet customers need

Connected vehicle data is transforming every area of fleet operations. Ten years ago, a fleet made purchasing decisions based on the availability of safety options, such as anti-lock brakes. Now, fleets want access to data and a new level of connectedness to streamline their operations.

In fleets today, vehicles are typically bought or leased to perform a specific operational business function. Purchasing decisions are made with a more rigorous analytical process and a focus on total cost of ownership (TCO), rather than purchase price.

As such, data has become critical to fleets. Data availability is now a major consideration when companies decide which make and model of vehicle to buy or lease.

In essence, understanding the data needs of fleets is essential, not only to vehicle sales, but to understand what services will provide value along the lifecycle of their vehicles.

What data are fleets looking for?

Fleets are looking for vehicle data that will enable them to optimize their operations and increase productivity, along with reaching safety, compliance and sustainability goals.

Here are some examples:

- Fleet optimization: Location data allows delivery fleets to create dynamic routes to improve the accuracy of delivery time estimates, minimize miles driven, and helps new mobility players facilitate the shared vehicle experience by locating free-floating cars. Fuel data is used to lower operational costs by car-share companies to determine accurate fuel usage by users for billing purposes.

- Productivity: Odometer data is used to optimize maintenance schedules and minimize downtime and tire pressure data helps identify vehicles in danger of suffering a blow-out.

- Safety: Acceleration, braking, speed and seatbelt data is used to develop driver safety programs.

- Compliance: Ignition data is used to adhere to government mandates that limit the number of on-duty hours for long-haul truck drivers.

- Sustainability: Engine data is used to reduce idling and carbon exhaust emissions.

As you can see, every fleet has nuances in the data they’re looking to collect.

However, most data can be grouped into three categories: (1) Must-have data, which forms the baseline requirements for vehicle purchases, (2) Should-have data, which represents data options that have the potential to further improve fleet efficiency, and (3) Nice-to-have data, which includes additional functionality.

It takes insight and experience to understand which data is business-critical to fleets, making it one of the optimal areas for partnering with a Telematics Services Provider (TSP).

Another consideration to take into account is:

How do fleets want to access their data?

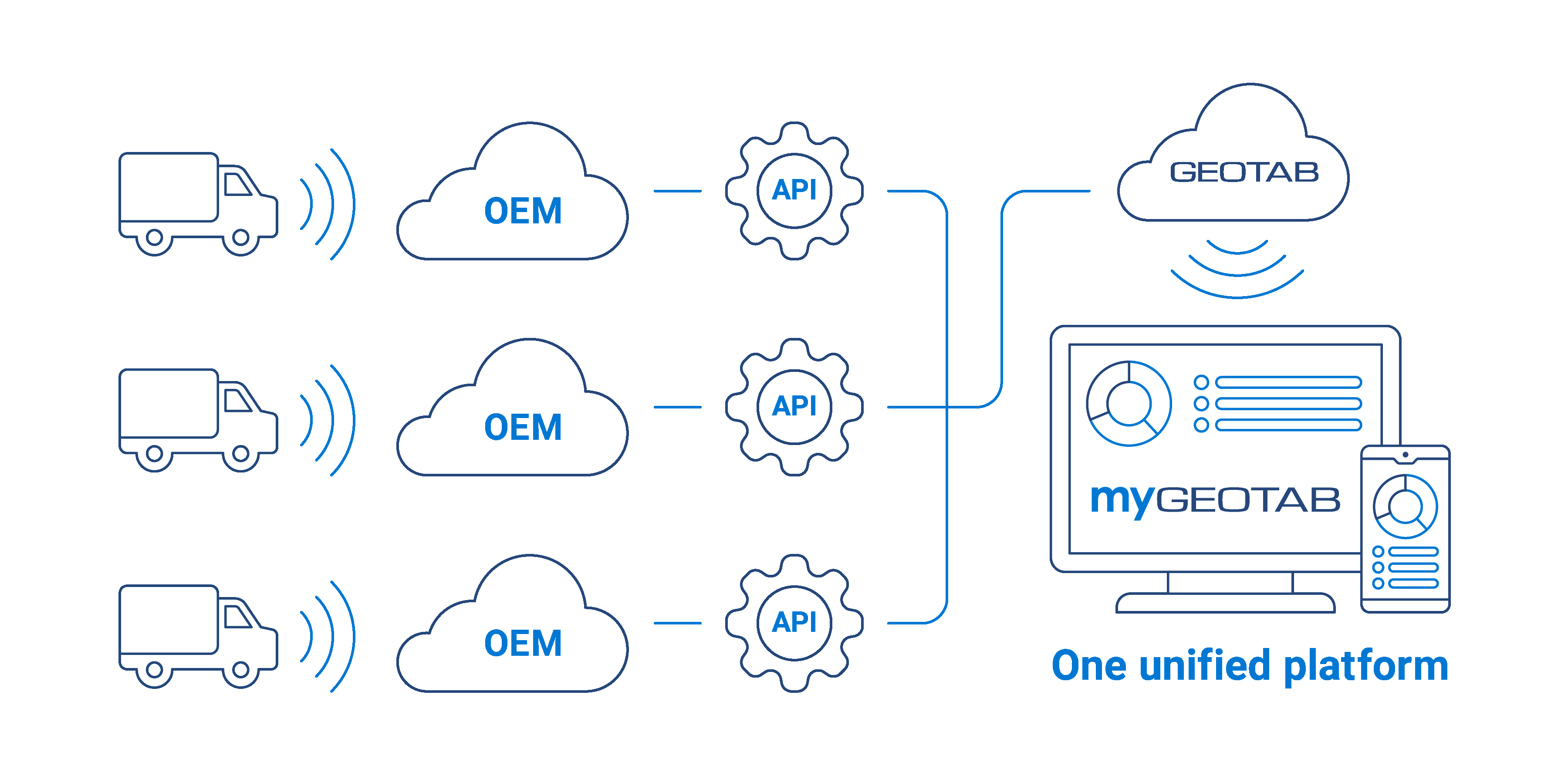

Fleets are looking to have access to all of their vehicle data on a single platform, one that integrates with internal systems such as transportation management systems (TMS) and enterprise resource planning (ERP) systems.

However, as vehicle selection is based on various costs and operational factors, approximately 90% of all commercial fleets have vehicles consisting of different manufacturers and/or older model vehicles without the capability to record vehicle data. Therefore, a solution that only allows fleet customers to manage vehicle data from one OEM will not provide them with the flexibility and capability they need to manage their entire fleet.

Just as automotive OEMs have built their core competencies over years of experience (i.e. optimizing internal processes and production lines, balancing innovation with pragmatic product development decisions, and filling market opportunities with strategic brands), telematics providers have built their expertise on a foundation of data and technology that can help OEMs effectively integrate with more fleet customers.

And with data being one of the big factors in fleet purchasing decisions, building strong relationships with industry-leading telematics companies is good for business.

What Telematics Service Providers (TSP) do well

Understanding what data fleets and fleet managers need has become paramount. With so much vehicle data available and nuances in the data that fleets collect, TSPs provide the insight and experience to transfer the right data, at the right frequency and extrapolate the business-critical data that is essential to fleet customer business operations. The process is highly technical and regulated by data privacy laws; it demands cutting-edge hardware, software, skills and expertise.

What to look for in a TSP Partner?

TSPs should bring a wealth of experience to the table. Ideally, they should have a quality product, a solid track record and an integration option that works specifically with your business model.

Heavy investment in product R&D is a good indicator of how much a TSP is committed to developing their own core competency. With a focus on the data and technology portion of the equation, strong providers enable OEMs to focus on their own core competency and ultimately provide a more robust solution.

Another consideration is expandability. A TSP with a strong ecosystem of integrated partners means that customers can expand their solution based on specific needs. Without that strong ecosystem, solutions can be rigid, static, and unable to effectively scale, which could translate to stagnant market positioning, especially with fleet customers.

Fluidity is another factor in selecting the right partner. TSPs work closely with customers as consultants — i.e., TSPs leverage customer feedback and data to continually improve the offering and provide customers with information and insights to make data-based decisions.

Geotab has extensive experience working in partnership with some of the world’s largest fleets, providing in-depth insights into the data and frequency needs of those fleets. We catalog these needs by level of importance and share these insights with OEMs to facilitate the various signals that are essential to a fleet’s business and operations.

Geotab invests over 12% of annual revenue in Research in Development to ensure our technology is top of the line. Rated #1

Revenue models for OEMs

According to a Mckinsey Report, OEMs can break out the benefits of data value creation into three categories: (1) Generating revenue from direct monetization tailored advertising and selling data; (2) Reducing costs associated with R&D material, customer behaviour and usage, and overall customer satisfaction; and (3) Increasing overall safety and security.

OEMs who can overcome the challenges associated with current monetization efforts and align their business models and internal teams to support value-added initiatives have lots of opportunities to partner with TSPs.

For example, Geotab has different partnership options that can bring telematics to your fleet customers and adds value in all three categories. Used to great effect by many OEMs to date, these branded OR white label options include:

- Integrate with Geotab’s OEM Data Platform: This provides access to Geotab’s vast sales ecosystem and customer base and a user-friendly, web-based fleet management solution that allows your fleet customers to monitor their mixed fleet from one platform.

- Whitelabel Geotab’s Fleet Management solution: This secure option allows you to quickly scale a solution to fleet customers. Geotab’s cloud-based telematics platform has an ISO 27001 certification and FedRAMP Authorization. You can brand the web-based solution, without the need to invest resources and budget in IT and security infrastructure for telematics.

- Installing Geotab’s telematics devices: This option provides you with instant access to a FIPS 140-2 validated telematics device that can be factory installed, allowing you to quickly scale a telematics offering to customers without the need to divert R&D dollars or time away from vehicle development.

- Exchange anonymized data: This option would involve selling your anonymized data to Geotab or purchasing anonymized data from our 2.5 million vehicles, which provides insights into your “legacy” or non-OEM-connected vehicles on the street.

OEMs should have the flexibility to partner with TSPs in a way that supports the full customer journey — and their business processes — and helps them realize new streams of revenue.

Become masters of a connected experience

If OEMs can define their core competency and leverage the expertise of TSPs, they will deliver a truly connected experience — for everyday customers and fleets alike, which can translate into greater brand loyalty and increased sales.

Better integration into the global mobility framework supports that vision of connectedness and means better end products and an enhanced ecosystem for the entire supply chain. In addition, shifting away from a transactional model to a fully integrated, customer journey model will help OEMs build stronger relationships with their customers and help fleet managers build stronger fleets.

Learn more about how you can partner with Geotab, contact us at OEMLD@geotab.com.

We’ve worked with the largest fleets in the world for 20 years and we help OEMs facilitate the signals that are essential to a fleet’s business and operations.

About Geotab

Geotab is a global leader in connected vehicle and asset solutions, empowering fleet efficiency and management. We leverage advanced data analytics and AI to transform fleet performance, safety, and sustainability, reducing cost and driving efficiency. Backed by top data scientists and engineers, we serve over 55,000 global customers, processing 80 billion data points daily from more than 4.7 million vehicle subscriptions. Geotab is trusted by Fortune 500 organizations, mid-sized fleets, and the largest public sector fleets in the world, including the US Federal Government. Committed to data security and privacy, we hold FIPS 140-3 and FedRAMP authorizations. Our open platform, ecosystem of outstanding partners, and Marketplace deliver hundreds of fleet-ready third-party solutions. This year, we're celebrating 25 years of innovation. Learn more at www.geotab.com and follow us on LinkedIn or visit Geotab News and Views.

© 2025 Geotab Inc.All Rights Reserved.

This white paper is intended to provide information and encourage discussion on topics of interest to the telematics community. Geotab is not providing technical, professional or legal advice through this white paper. While every effort has been made to ensure that the information in this white paper is timely and accurate, errors and omissions may occur, and the information presented here may become out-of-date with the passage of time.

Recent News

Geotab Ace: Revolutionizing Fleet Management with Responsible Generative AI

December 2, 2024

4 ways to unlock the power of quality data

June 30, 2023

Your comprehensive guide to the Canadian ELD mandate

May 16, 2022