Fleet safety ROI: How to prove, measure and improve it

Fleet safety ROI calculates the financial gains from safety programs, such as reduced collisions and lower insurance costs. Learn step-by-step formulas and key metrics.

By Geotab Team

Oct 6, 2025

Key Insights

- Fleet safety ROI proves the financial value of safer operations, helping fleets justify investments to leadership and insurers.

- A clear ROI formula with defined costs and benefits makes results measurable and defensible.

- Leading and lagging indicators, from harsh events to collision rates, create a balanced scorecard for tracking improvement.

- Benchmarking against top-quartile fleets helps you find ways to lower costs, reduce collisions and save on insurance.

Fleets today face rising insurance premiums and increasing collision costs, yet many still struggle to quantify the return on their safety investments. Fleet safety ROI provides a clear way to measure financial impact, justify budgets and reduce risk.

Fleets that invest in predictive analytics, targeted driver coaching and real-time monitoring consistently outperform their peers in both cost savings and risk reduction. To maximize these results, many companies rely on dedicated solutions like the Geotab Safety Center and a comprehensive fleet safety program tailored to their needs.

In this guide, we’ll break down how to calculate ROI, the metrics that matter most and the benchmarks that define top-quartile fleets.

Why fleet safety ROI matters

Compliance is just the beginning, fleet safety ROI matters because it demonstrates lower collision costs and supports business growth. .

With insurance premiums and claim costs climbing, fleet leaders must prove that every safety investment delivers measurable returns. Fleet safety ROI gives you that lens.

Justifies safety investment in a high-cost environment

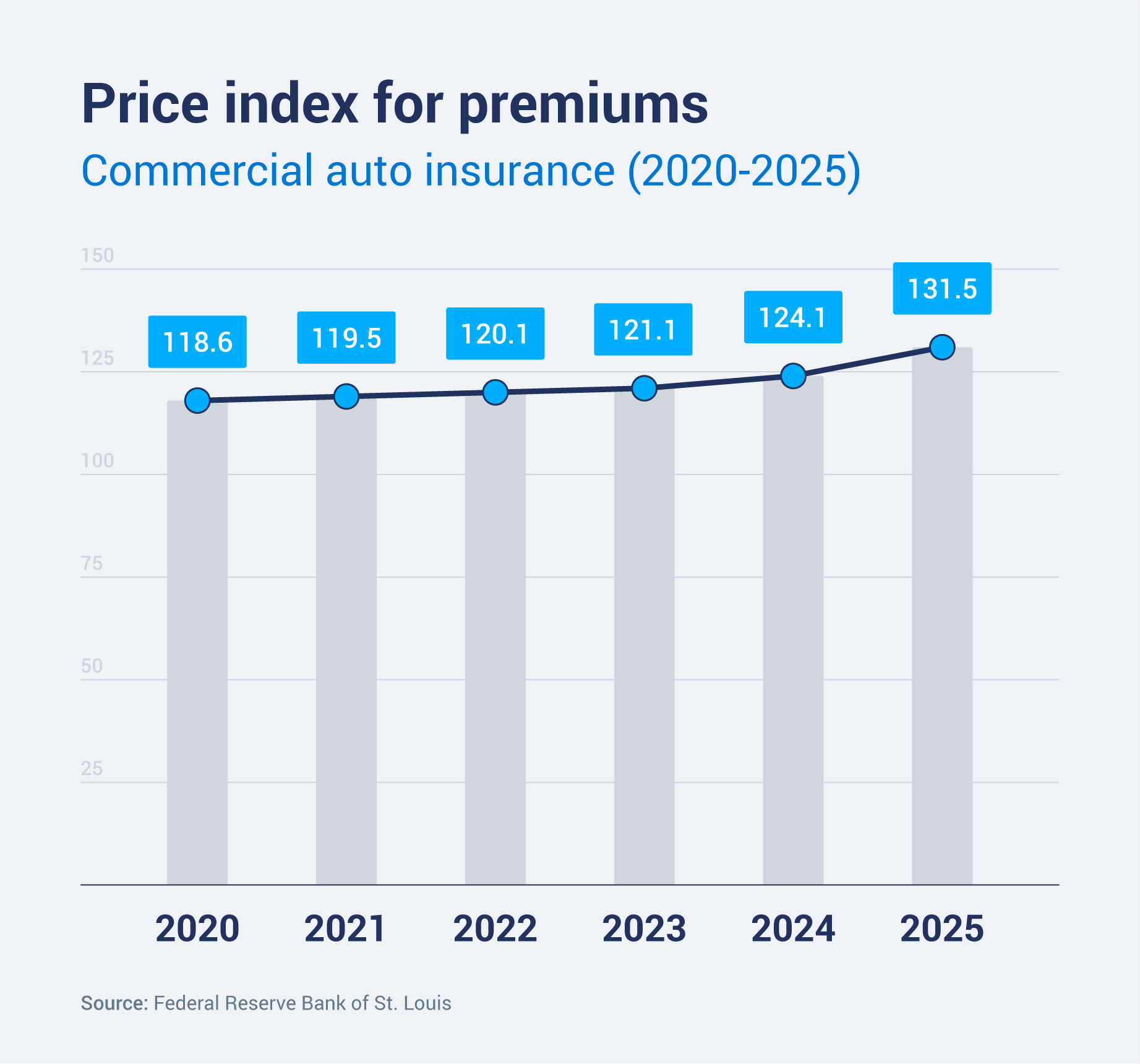

Commercial fleet insurance premiums rose by 9%-9.8%1 in the first half of 2024 alone. At the same time, increased highway exposure and broader risk-sharing have pushed collision and repair costs even higher.

Amid shrinking profit margins, fleet executives expect safety programs to pay for themselves by showing measurable losses avoided. This pressure makes ROI the language of leadership and the standard for evaluating every safety dollar spent.

Turns real-time data into proactive risk prevention

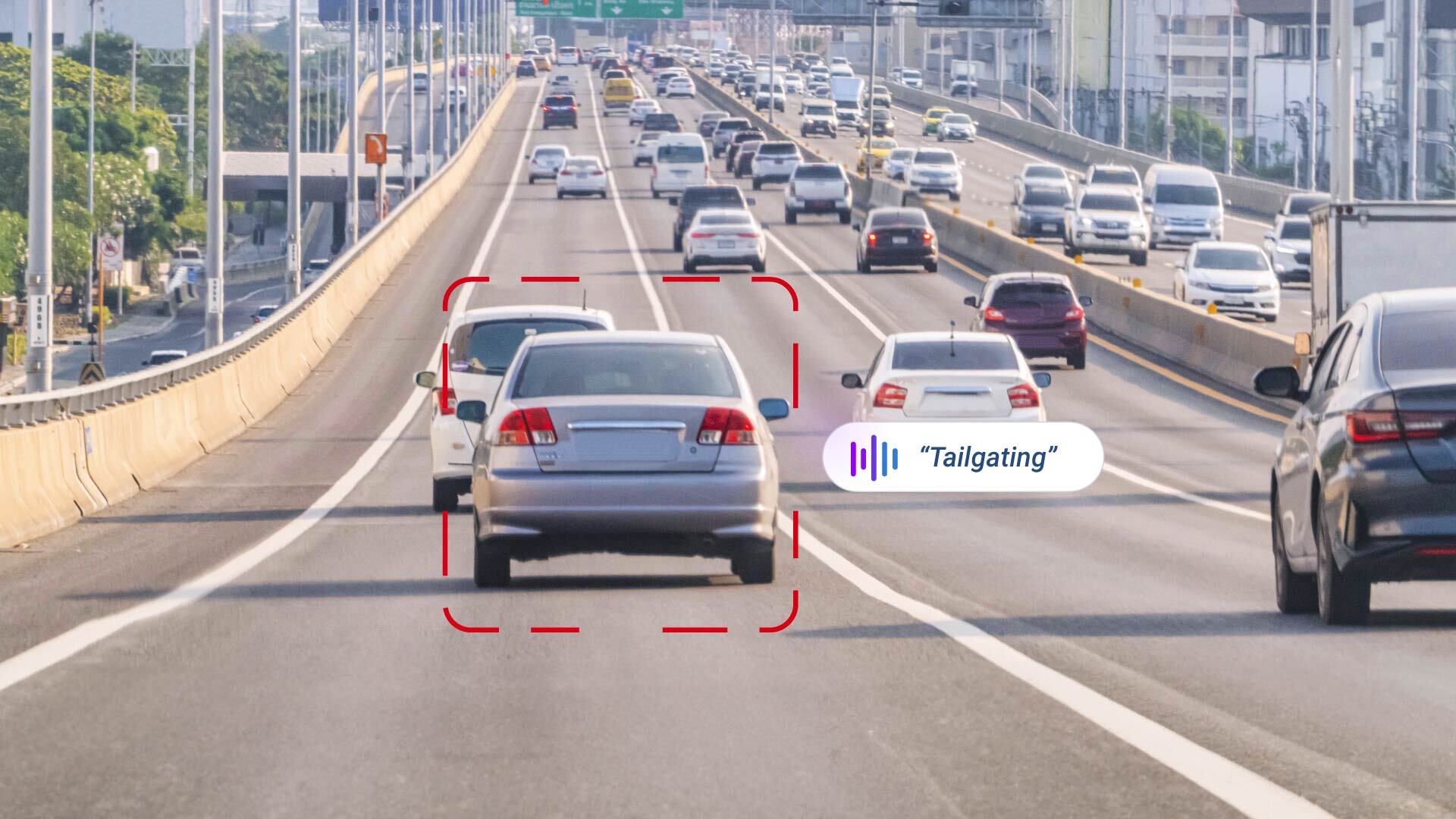

Fleets are moving away from reactive incident logs to AI‑driven predictive analytics. Predictive analytics uses historical and real‑time data to forecast future collision probability.

The Geotab Safety Center’s Driver Risk Insights helps fleets identify high-risk drivers before a collision occurs by assigning each a risk probability and benchmarking them against peers. With live fleet incident reporting, managers can act early to reduce risk instead of reacting after an incident.

Builds internal trust and buy-in

Demonstrating measurable improvements in safety fleet metrics builds credibility across the organization. It shows that safety investments deliver value beyond fleet compliance management by supporting financial performance and workforce well-being. Examples include:

- Fewer collisions reported across the fleet

- Lower claims frequency and faster resolution

- Reduced insurance costs year over year

When fleet leaders share a common view of results, it becomes easier to align on budgets and priorities. This alignment creates a culture of accountability where safety is seen as a driver of efficiency, not just a regulatory requirement.

Tools that make progress visible and actionable include:

- Driver scorecards that track individual performance

- Trend dashboards that highlight long-term improvement

- Incident heatmaps that identify problem areas

By sharing these insights in regular reviews, managers can highlight wins, identify new risks and secure continued leadership support for future safety initiatives.

Helps fleets build a foundation for long-term growth

A proven safety track record pays dividends over time. Lower collision rates help secure better insurance terms, smooth audit outcomes and strengthen your brand’s trust among customers and drivers.

Safety-savvy fleets also attract and retain better drivers, especially in a tight labor market. Meeting evolving compliance needs, from Hours of Service (HOS) to driver-vehicle inspection reports (DVIRs) and emissions, becomes easier with proactive systems.

Formula to calculate fleet safety ROI

In ROI fleet management, the key is to keep calculations simple and consistent. Use the same cost and savings categories each time and measure performance over a standard period, usually 12 months. This makes results easier to track and explain to executives and aligns with best practices explained in Geotab’s fleet safety insights.

Step-by-step equations

- ROI = (Total benefits − Program cost) ÷ Program cost

- Payback period = Program cost ÷ Monthly net savings

- Monthly net savings = Monthly benefits − Monthly ongoing costs

How it works

- Total benefits should include reduced collision costs, lower insurance premiums, fewer repairs and faster claims handling.

- Program cost covers both direct costs (hardware, installation, training) and indirect costs (downtime, internal admin time).

If a fleet invests $50,000 in safety technology and saves $150,000 in reduced collisions and insurance costs over 12 months:

- ROI = ($150,000 − $50,000) ÷ $50,000 = 2.0 or 200% ROI

- Payback period = $50,000 ÷ $12,500 monthly net savings = 4 months

This means the fleet recoups its investment within four months and generates ongoing savings for the rest of the year.

| Pro tip: Keep costs net of tax incentives and grants, and separate one-time setup costs from ongoing expenses to make ROI comparisons accurate. |

Key steps to prove fleet safety ROI

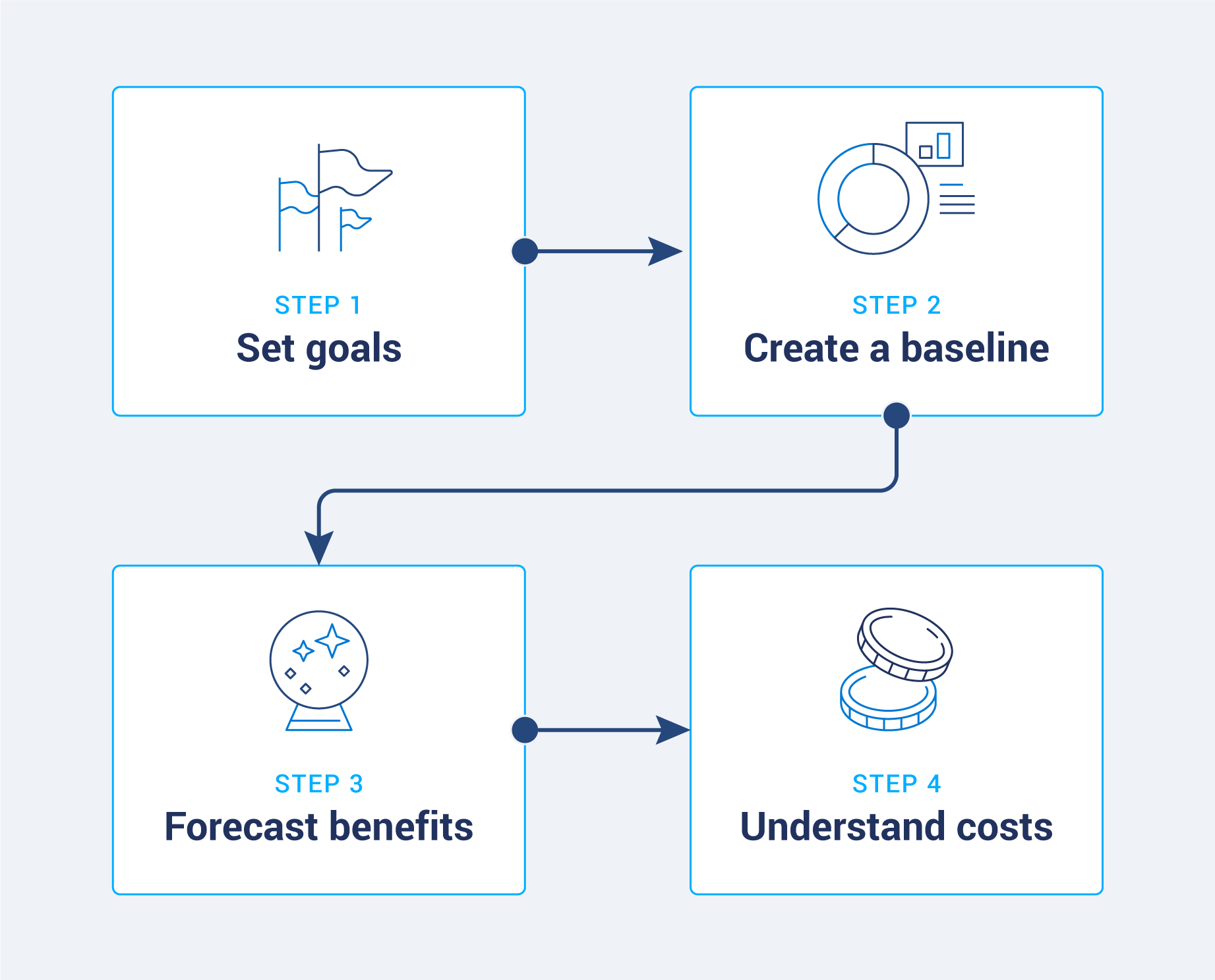

Proving ROI starts with accurate data and a clear understanding of both costs and benefits. These four steps will help you measure impact and build a strong business case:

1. Define the problem and set measurable goals

Identify your biggest pain points, such as frequent collisions, rising insurance premiums, high driver turnover or excessive maintenance costs. Then, set clear targets.

| Example: Aim to reduce preventable collisions by 20% within the next 12 months or cut insurance costs by 10% in two years. |

2. Establish your baseline

Before making changes, capture a snapshot of your current performance. Collect at least 12 months’ worth of historical data on:

- Number and severity of collisions

- Insurance premiums and claims costs

- Maintenance and fuel expenses

- Driver turnover rates

This baseline will be your benchmark for measuring improvement.

3. Understand the full cost of safety investments

Account for every expense tied to safety initiatives, like:

- Direct costs: Hardware purchases, installation fees, software licenses and driver training programs

- Indirect costs: Vehicle downtime during installation, time spent by internal staff on implementation and change management efforts

Accurate cost tracking ensures ROI calculations are credible.

4. Forecast quantifiable and intangible benefits

Estimate the return you expect from safety investments. Include:

- Hard-dollar savings: Reduced collision costs, lower insurance premiums, faster claims processing and fewer repair expenses

- Intangible benefits: Improved brand reputation, stronger driver retention and better compliance with regulations

By weighing both tangible and intangible benefits against total costs, you can present a complete picture of value.

Top ROI metrics for fleet driver safety

Tracking the right ROI metrics ensures you can measure the impact of safety programs and make informed decisions.

Metrics fall into two categories: leading indicators that predict future risk, and lagging indicators that confirm results after incidents occur.

Leading indicators

Leading indicators identify potential safety issues before they result in collisions. These proactive measures give managers time to coach and correct. Examples of leading indicators include:

- Harsh events: These are instances of harsh braking, acceleration or cornering per 1,000 miles. Fleets should aim for fewer than 15 per 1,000 miles.

- Near misses: These refer to incidents where a collision was narrowly avoided, often captured by telematics data or dash cam review. A good benchmark is fewer than five per 1,000 miles.

- Risk score: This driver-level score predicts the likelihood of a collision based on historical behavior and real-time data.

In the Geotab Safety Center, each driver is assigned a collision risk probability calculated from a mix of event frequency, severity and contextual factors such as road type and time of day.

This allows managers to prioritize coaching for the drivers most likely to be involved in a collision, making safety programs more efficient and cost-effective.

| Pro tip: Pairing these metrics with a fleet safety grader provides a snapshot score that simplifies communication with executives and insurers. |

Lagging indicators

Lagging indicators measure actual outcomes over a set period. They validate whether proactive safety measures are working and help demonstrate value to executives and insurers.

- Collision rate: This refers to the number of collisions per 100,000 miles driven. Top-performing fleets target below 0.07 per 100,000 miles.

- CSA score: This score represents the Compliance, Safety, Accountability BASICs used by the FMCSA to evaluate safety performance. The lower the score, the better, but best-in-class fleets keep all BASIC categories under 50.

- Commercial truck insurance cost per mile: This is the total insurance premium divided by the total miles driven.

By pairing leading and lagging indicators, fleets create a balanced scorecard for safety performance. Leading metrics help prevent incidents, while lagging metrics confirm improvements and build a strong ROI case for executives, insurers and regulators.

Real benchmarks to gauge safety performance

To prove ROI, fleets need context. Benchmarks allow you to compare your results with peer groups by fleet size, vehicle type and industry. These comparisons show whether your safety program is average, lagging or among top performers. Reliable fleet safety tracking is what makes these comparisons possible.

Here are some benchmarks to know:

Collision rate and severity by industry and fleet size

Collision frequency and severity vary widely across vehicle classes and industries. Light-duty fleets typically experience higher frequency but lower severity incidents, while heavy-duty fleets face fewer but more costly collisions.

CSA scores and cost per mile

Insurance costs provide another reliable benchmark. The national average sits at approximately $0.07 per mile, while top-quartile fleets achieve approximately $0.06 per mile or less. Lower costs per mile reflect fewer collisions, proactive claims handling and stronger safety programs.

In terms of CSA score performance, industry leaders target an Unsafe Driving BASIC score under 50. Continuous monitoring of CSA scores gives fleets leverage with insurers and strengthens their ROI story.

What top-quartile fleets achieve

Top-quartile fleets consistently demonstrate the ROI of safety by outperforming industry averages. They report:

- 40% fewer preventable collisions compared to the median

- 9-point CSA improvement year over year

- 10% premium rebate from insurers participating in verified telematics discount programs

These benchmarks show what’s possible when fleets use predictive safety analytics, targeted driver coaching and continuous improvement practices.

How to maximize your fleet’s safety ROI

Turning data into action is the key to improving fleet management service ROI. These strategies help you apply analytics consistently and keep safety gains growing year after year. In particular, optimizing your fleet safety program with AI allows managers to predict risks earlier, coach drivers more effectively and sustain long-term results.

Here’s how to maximize your fleet’s safety ROI in three steps:

1. Connect your telematics software

Leveraging telematics is a great way to get the most out of your ROI. Integrate your telematics platform with a business intelligence (BI) dashboard to create live scorecards that track safety performance in real time.

Tools like the Geotab Data Connector make it simple to connect to Power BI or Tableau, so leadership can view updated KPIs at any time.

Update dashboards daily to maintain executive engagement and ensure operational decisions are based on the most current data. This real-time visibility helps identify emerging risks, track driver performance and measure the direct impact of safety investments.

2. Prioritize coaching with driver-level risk probability

Focus your safety resources where they will have the greatest impact. Using driver-level risk probability, assign coaching sessions to the top 20% of high-risk drivers first. This targeted approach addresses the behaviors most likely to lead to collisions.

Many fleets adopt strategies from field service driver coaching programs, which emphasize focusing on the most at-risk drivers and tailoring sessions to their specific behaviors.

For context, the fleet risk management guide shows how structured coaching fits into a larger safety framework that balances technology, policy and culture.

Fleets that prioritize high-risk drivers in their coaching program can reduce collision rates significantly. Incorporating personalized coaching and follow-up reviews also improves driver engagement and reinforces safer habits.

3. Build a continuous improvement loop with quarterly reviews

Establish a three-step cycle to keep ROI trending upward:

- Analyze performance data and identify patterns or outliers.

- Act on findings by updating training, technology settings or policies.

- Audit results to confirm improvements and uncover new opportunities.

Review KPIs quarterly, set measurable targets and celebrate progress to keep teams motivated. Consistent reviews also ensure compliance with safety and operational standards, which strengthens your position during audits and supports your path to becoming fleet safety certified.

Build a long-term ROI-driven fleet safety strategy with Geotab

Quantifying fleet safety ROI is no longer optional. Rising premiums, repair costs and operational pressures demand a clear business case for every safety investment. By tracking the right metrics, applying proven formulas and benchmarking against top performers, fleets can show measurable financial returns alongside safer operations.

Now is the time to turn your safety data into a business advantage. Explore fleet safety solutions with Geotab to see how predictive analytics, driver scorecards and risk insights can help you calculate and maximize ROI.

Sources

Subscribe to get industry tips and insights

Frequently Asked Questions

Collision rate per 100,000 miles, insurance cost per mile and claims frequency are top indicators. Leading metrics like harsh events, near-miss counts and driver risk scores help track improvement before incidents happen.

Dash cams provide objective video evidence that can exonerate drivers, reduce false claims and speed up settlements. They also support coaching programs that improve driver behavior, helping lower collision rates over time.

Most fleets break even within 12 to 18 months2 when factoring in device installation, training and premium rebates.

Carriers typically accept timestamped telematics logs, driver scorecards and verified collision video footage as audit-ready evidence of improved safety performance.

EV fleets often achieve faster ROI due to lower fuel and maintenance costs, while safety improvements remain consistent across both electric and internal combustion engine (ICE) vehicles.

Statistically valid benchmarking starts at around 50 vehicles, but predictive analytics models become more accurate after 100,000 cumulative miles of collected data.

Geotab’s fleet safety checklist is a simple but powerful way to track training, inspections and policy adherence. Combined with telematics data, it helps managers verify that every element of the safety program is in place.

Geotab Team

The Geotab Team write about company news.

Table of Contents

Subscribe to get industry tips and insights

Related posts

Collision avoidance systems: How fleets prevent incidents and improve safety

December 23, 2025

5 minute read

.png)

From the North Pole to the Highway: How AI and Predictive Insights Get Drivers Home for the Holidays

December 16, 2025

2 minute read

.jpg)

.png)

AI dash cams vs. traditional: Which delivers better fleet safety?

December 8, 2025

5 minute read

Elevating Worker Safety Through Simplicity: The OK Alone Story

December 3, 2025

2 minute read

Geotab GO Focus Plus Camera Rules, Thresholds, and Event Buffers Explained

October 27, 2025

2 minute read