Telematics insurance: Fleet manager’s guide on how it works, benefits + provider options

Discover how telematics insurance can sharpen your fleet’s safety and cut costs, without overhauling your entire operation.

By Geotab Team

Aug 6, 2025

Key Insights

- Insurance telematics uses a small in-vehicle device or mobile app to capture GPS location, speed, braking and mileage data, letting insurers set premiums in real time.

- Telematics insurance policies reward safe driving with discounts and improve risk management, but they raise privacy concerns and generate large data volumes that require robust analysis tools.

- To implement smoothly, train drivers on vehicle tracking devices and integrate telematics solutions with existing fleet management systems.

When you’re facing surging fuel bills (15% of costs), surprise breakdowns (28% of costs) and rising insurance premiums, the unplanned downtime and safety incidents can derail schedules and erode client trust. With 39% of fleet professionals citing new vehicles as their largest expense, controlling these costs remains a top concern.

Insurance telematics steps in as your eyes and ears on the road. It uses GPS, onboard diagnostics and sensors to track vehicle location, engine health and driver behavior in real time. You spot excessive idling, harsh braking or engine faults before they become costly repairs. Telematics device cost is often minimal compared to the savings from early detection.

Learn more about how telematics can help with that, plus how to integrate telematics data into your insurance strategy and unlock the full value of every mile.

What is telematics insurance?

Insurance telematics applies telematics technology to auto insurance to collect driving data that insurers use to assess risk and set premiums. It relies on GPS trackers that record metrics like speed, distance, braking and time. Insurers use this telematics data to build personalized risk profiles and offer customized usage-based insurance (UBI) programs.

Insurance telematics promotes fairer pricing and rewards safe driving habits by basing rates on actual driving behavior rather than broad demographic factors. You can lower claims costs and secure premium discounts by demonstrating low-risk driving patterns through telematics data. It also enables early detection of risky behaviors and mechanical issues.

How does telematics insurance work?

Insurance telematics powers telematics insurance policies by tapping into vehicle monitoring systems and fleet data analytics. A telematics policy is simply a usage-based contract that ties your premiums to actual driving behavior.

Here’s a quick overview of how telematics car insurance works:

- Install a device: You fit a telematics black box into each vehicle’s OBD-II port.

- Collect data: The system logs metrics like speed, harsh braking, rapid acceleration, cornering, idle time, location and engine health.

- Transmit data: It sends the raw data over cellular or Wi-Fi networks to a secure cloud server. Fleet data analytics platforms then process and organize the information.

- Analyze behavior: Analytics tools flag unsafe events — like aggressive braking or extended fleet idling — and highlight maintenance issues before they escalate.

- Adjust premiums: Insurers review these personalized risk profiles and set your premiums based on actual mileage and driving habits. Good drivers earn discounts under UBI models.

Benefits of insurance telematics for fleets

Insurance telematics offers many advantages that help ultimately streamline operations and manage your fleet more cost-effectively.

Improved safety

Real-time feedback and driving scores encourage safer habits on every trip. When drivers see their scores drop after harsh braking or speeding, they adjust their behavior immediately to protect themselves — and your assets. It’s similar to what a driver behavior monitoring system does.

Potential for lower premiums

Telematics tracks safe driving patterns, such as smooth acceleration and minimal idling, that insurers reward with discounts. Over time, these UBI models can shrink your fleet management costs and overall insurance spend. Here are some ways to get discounts:

- Install approved telematics devices

- Train drivers for smooth driving

- Use dash cams or in-cab cameras

- Keep vehicles well-maintained

Enhanced risk management

You gain a more accurate driver risk assessment than traditional rating factors allow. Granular data on when, where and how your vehicles operate helps you proactively address high-risk patterns before they lead to claims.

Greater transparency

Telematics gives you data-backed insights into driver behavior and vehicle health. Dashboards and automated reports let you spot trends at a glance, so you always know which drivers excel and which routes cost you the most. You can also use this data to optimize routes.

Increased efficiency

Insurance telematics solutions integrate seamlessly with your existing fleet management software. You streamline admin tasks, such as claims documentation and compliance reporting, while centralizing vehicle monitoring systems and fleet data analytics in one place.

Considerations for usage-based insurance telematics

Telematics usage-based, or pay-per-mile, insurance can offer savings, but it carries several drawbacks that you must weigh before adopting. For instance, you risk penalizing drivers for necessary maneuvers and face new operational challenges around data and technology.

Not everyone is a safe driver

Usage-based programs evaluate every brake and acceleration, even those needed for defensive driving. If your fleet lacks a strong fleet safety program, you may see premium increases instead of discounts. Despite safe intent, drivers in high-traffic or complex routes may struggle to maintain top scores.

Privacy concerns

Telematics devices log location, speed and driving events around the clock. Fleets worry about who accesses this sensitive data and how they may use it (beyond insurance pricing). A breach or misuse of data can erode driver trust and attract legal scrutiny.

Data management and analysis

Telematics systems generate vast volumes of raw data. Without proper analytics tools or expertise, you may miss key insights or drown in irrelevant metrics. Poor data governance can lead to incorrect risk assessments and misguided safety initiatives.

Potential for technical issues

Hardware failures or app glitches can disrupt data collection. Connectivity problems in remote areas may create gaps in your records, affecting insurance evaluations. Maintaining and updating devices adds a hidden layer of cost and complexity.

Here’s a quick refresher on insurance telematics:

Advantages | Considerations |

|---|---|

|

|

Tips for implementing fleet insurance telematics

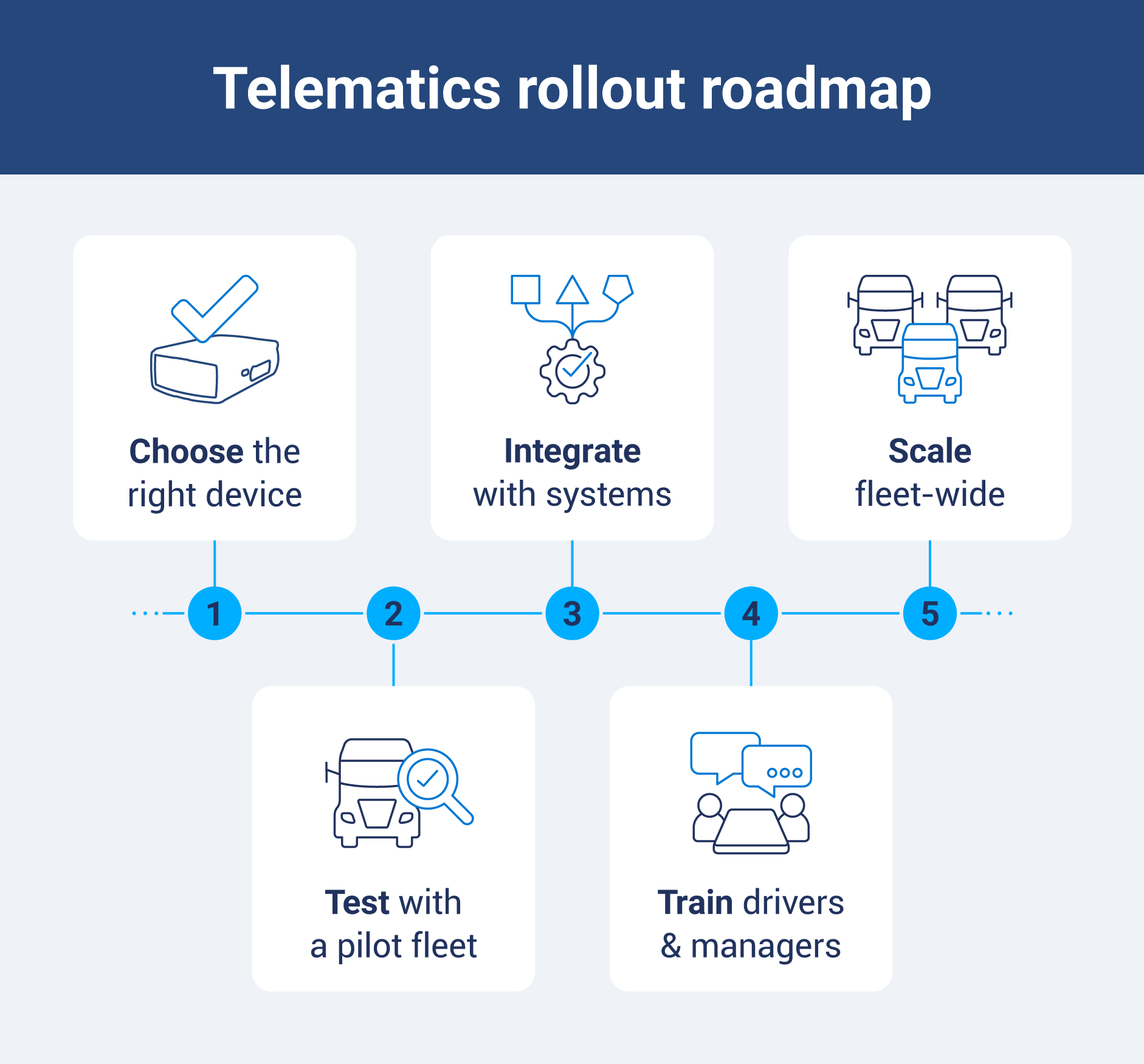

Deploying insurance telematics solutions starts with choosing the right vehicle tracking device and a clear rollout plan. A structured approach helps you unlock usage-based discounts while aligning drivers and operations.

Here are some tips to help you make the most out of fleet insurance telematics:

- Consider important features by evaluating data accuracy, real-time alerts, driver behavior scoring and open APIs for integrations.

- Roll out telematics on a small subset of vehicles to test hardware, data flows and user buy-in before scaling fleet-wide.

- Explain how telematics supports safety, efficiency and insurance savings. Be transparent about what you track and why.

- Ensure your telematics platform connects seamlessly with fleet management software, maintenance systems and insurer portals.

- Provide hands-on driver coaching on the tracking device. Teach managers how to interpret reports and coach behavior.

- Verify that vendors encrypt data in transit and at rest. Establish policies on who can access location and driving data.

Simplify fleet management with an all-in-one telematics solution

Insurance telematics streamlines your operations by delivering real-time insights on driver behavior, vehicle health and route efficiency. You cut costs through proactive maintenance alerts and usage-based insurance discounts.

With Geotab’s telematics solution, you get access to GPS tracking, engine diagnostics and driver coaching tools, thanks to a combination of its plug-and-play GO device and the MyGeotab cloud platform.

You access features like advanced reporting and AI-powered analytics to prove safe driving to insurers and unlock the best usage-based insurance rates. Schedule your demo today to learn how it can benefit your fleet.

Subscribe to get industry tips and insights

Frequently Asked Questions

Telematics in insurance refers to using in-vehicle devices or mobile apps to collect data on driving behavior, such as speed, braking and mileage, to set usage-based premiums. These telematics insurance policies reward safe driving by tailoring rates to actual driver habits rather than broad demographics.

Insurers deploy telematics to gain accurate, real-time insights into risk, enabling them to price policies more fairly and competitively. They also use this data to encourage safer driving behavior, which reduces claim frequency and overall loss costs.

Telematics can raise privacy concerns, as continuous tracking logs sensitive location and driving data that some drivers may find intrusive. It can also overwhelm fleets with large data volumes, requiring robust analytics tools and expertise to avoid misinterpretation and governance challenges.

Yes — if you opt into a telematics program, insurers can track your vehicle’s location, speed and driving events via a plug-in device or mobile app. Without your consent, however, insurers generally cannot force-install tracking devices or access telematics data.

The Geotab Team write about company news.

Table of Contents

Subscribe to get industry tips and insights

Related posts

Building resilient school bus operations through four student transportation trends

February 24, 2026

6 minute read

Telematics trends for 2026: What is changing and how fleets can respond

January 30, 2026

6 minute read

Fleet GPS tracking systems cost: Full price breakdown and ways to boost ROI

January 30, 2026

6 minute read

Fleet operations: Key components, benefits and challenges

January 7, 2026

4 minute read

.jpg)

10 best fleet management software to boost performance and cut costs

December 22, 2025

8 minute read