What is IFTA?

The International Fuel Tax Agreement, also known as IFTA, is an agreement for fuel tax collection and sharing among 48 states and 10 provinces.

The International Fuel Tax Agreement — also known as IFTA — is a fuel tax collection and sharing agreement for the redistribution of fuel taxes paid by interstate commercial carriers. There are 58 member jurisdictions of IFTA, including 48 American states and 10 Canadian provinces.

By requiring commercial carriers to pay fuel taxes proportionally, according to the miles driven in each state or province, the agreement ensures that each jurisdiction has its fair share of revenue to put towards roads and transportation. Historically, motor fuel taxes have funded transportation. The first fuel taxes of 1919 and the 1-cent gas tax, formalized in 1933, were instituted to help balance the federal budget and pay for public works to boost the economy. In 1956, it was decided that fuel tax revenue should be directed to the new Highway Trust Fund for supporting the growing Interstate System and highways.

Under the IFTA agreement, qualified motor carriers can obtain an IFTA license for their motor vehicles allowing them to travel through other IFTA jurisdictions and submit only one quarterly fuel tax return in their base jurisdiction for fuel usage. If motor carriers aren’t registered with IFTA, they must comply with the fuel tax reporting guidelines of each individual jurisdiction in which they travel, which may include purchasing fuel trip permits. IFTA is an important part of fleet compliance, in addition to the ELD mandate and Hours of Service management.

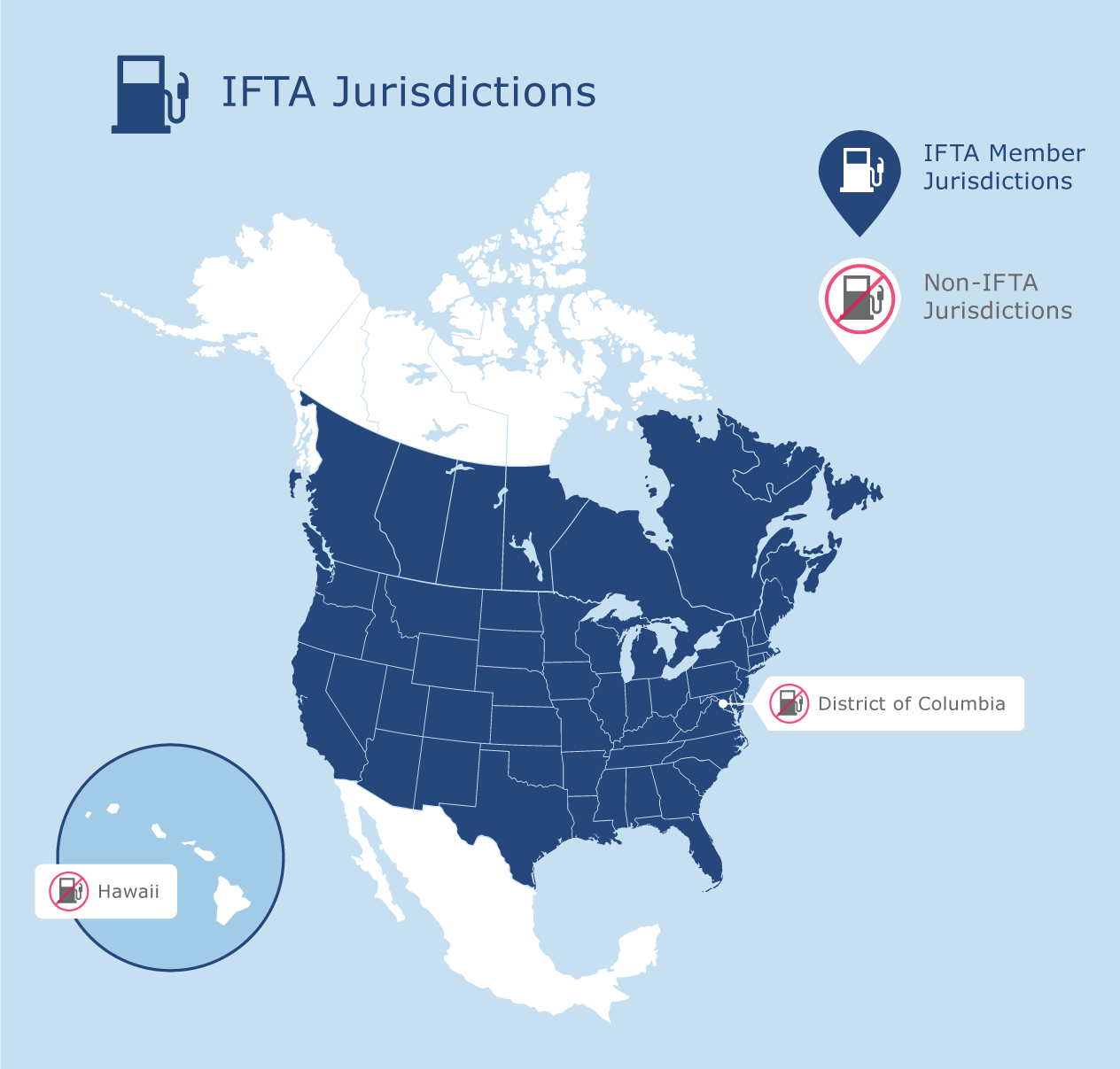

What Are the IFTA and Non-IFTA Jurisdictions?

The member jurisdictions of IFTA work in cooperation to administer, collect, and share motor fuel taxes. IFTA credentials are valid for travel in the lower 48 in the U.S. and 10 provinces of Canada. There are several jurisdictions that are not IFTA members where IFTA credentials are not valid, these include: Alaska, Hawaii and the District of Columbia, the Northwest Territories, Nunavut and Yukon, as well as all the states and Federal District of Mexico.

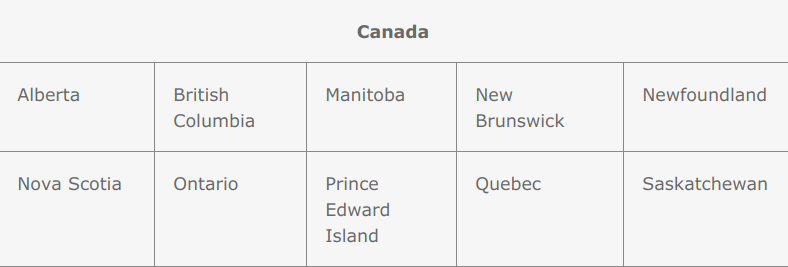

The table below summarizes all the IFTA members and non-IFTA jurisdictions in the United States and Canada.

List of IFTA Member Jurisdictions:

The IFTA Reporting Process

Under IFTA, commercial carriers must keep detailed records on miles driven, fuel purchased, and fuel tax paid in each state or province that their vehicles travel in. Carriers submit these records to their base jurisdiction on a quarterly basis for review. The base jurisdiction determines whether they owe taxes or will receive a credit. Since the allocation of taxes is such a huge and complex undertaking, IFTA, along with the International Registration Plan (IRP), oversee the process and provide assistance and guidance to states and provinces on running their individual programs.

Overview of the IFTA Process:

- Carrier submits an IFTA license application in the base jurisdiction.

- Base jurisdiction reviews and processes the license application.

- Carrier receives IFTA license and two decals for each qualified vehicle. A copy of the license must be placed in the vehicle during operation.

- At the end of each quarter, the licensed carrier files a quarterly IFTA tax return to the base jurisdiction for fuel used and remit any amounts due.

- Review and processing of the IFTA tax return by the base jurisdiction.

- A transmittal report is sent by the base jurisdiction to the other jurisdictions in which the vehicle operated in.

- Base jurisdiction processes all transmittal reports and payments from other states

- Business pays base jurisdiction what is owed, base jurisdiction pays other jurisdictions what they owe and collects from other jurisdictions what is owed to them.

Do I Need an IFTA Licence?

Carriers must obtain an IFTA license for qualified motor vehicles that travel in more than one IFTA member jurisdiction. The IFTA Articles of Agreement defines a Qualified Motor Vehicle as a motor vehicle used, designed, or maintained for the transportation of persons or property, that also has the following:

- Two axles and a gross vehicle weight (GVW) or registered GVW of more than 26,000 pounds or 11,797 kilograms; or

- Three or more axles regardless of weight; or

- Is used in a combination, and the combination has a GVW or registered GVW of more than 26,000 pounds or 11,797 kilograms.

Carriers can apply for an IFTA license in their base jurisdiction. They will receive a license and two decals for each vehicle, which must be renewed annually.

IFTA Exemptions

There are a number of vehicle, fuel, and distance exemptions allowed for IFTA, but they vary by jurisdiction. For example, recreational vehicles, farm plated vehicles, school buses, tow trucks, and government-owned vehicles are exempt in some states and provinces but not all. Biodiesel is also exempt from IFTA according to the 2017 list. The full list of IFTA exemptions is posted on the International Fuel Tax Association website.

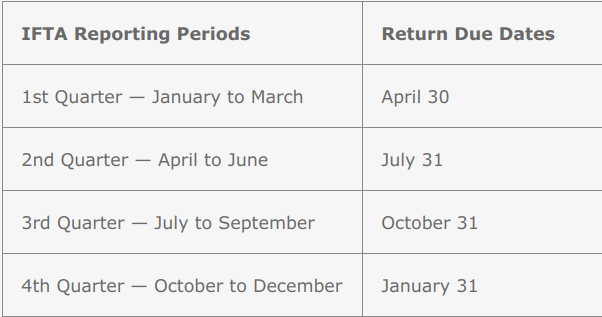

IFTA Fuel Tax Reporting and Due Dates

Carriers submit a quarterly tax return to their base jurisdiction that covers motor fuel usage and the distance traveled in IFTA member jurisdictions for all their qualified vehicles. Even if the carrier has not conducted any operations or used taxable fuel for a particular period, a report must be filed.

The due dates for filing a tax return and submitting payment are the last day of April, July, October, and January (or if that day falls on a weekend or holiday, the next business day).

Quarterly Tax Reporting Periods

Please contact your local compliance authority for the most up to date information on regulations in your area.

In addition to submitting tax returns, license holders must also keep detailed records of distance traveled, motor fuel purchased and used, any trip permits, monthly/quarterly summaries, and Individual Vehicle Distance Records (IVDRs).

What Are the Penalties for Failing to Comply with IFTA?

Penalties apply for failing to comply or filing late. Each IFTA jurisdiction has their own specific rules, but most follow a framework. For example, both California and New York assess a $50.00 or 10% penalty if you fail to file your return, file after the due date, or fail to be the amount due. However, Texas expands the rule to say, “If your failure to pay the taxes is due to fraud, you will be subject to a penalty of two times the amount of tax due.”

If you travel to an IFTA jurisdiction without a permit, you may be assessed a penalty, fine, or citation — depending on the jurisdiction’s laws. In California, you could be given a $100 to $500 penalty.

IFTA Auditing

Each member jurisdiction in IFTA is required to audit 3% of its licensed base annually to verify compliance and ensure the correct tax is being paid. While the prospect of an IFTA audit may cause distress among some, they serve an important purpose.

Gary Markham, Dir.of National Accounts and Regulatory Compliance Services at ProMiles Software Development Corporation explains, “It is best to keep in mind that most auditors are really there to help. I know that’s something most carriers find hard to believe, but IFTA audits are intended to ensure carrier compliance not to generate revenue.”

One way to make IFTA compliance easier is to keep accurate records. Markham recommends following this as a best practice. He says, “Good record keeping is very important when preparing your IFTA and Mile Tax returns. In the event of an audit, poor or sloppy records can cost a carrier large sums of money in penalties and interest, disallowed fuel, additional miles or an MPG reduction. If a carrier has good records, the audit becomes more of a process validation than a records audit. If complete supporting information is provided to an auditor, be it manual records or GPS data, the audit tends to go much smoother.”

History of the International Fuel Tax Agreement (IFTA)

The goal of the International Fuel Tax Agreement, as set out in the IFTA Articles of Agreement, is to harmonize the administration of motor fuels use taxation among member states and provinces. The core documents of IFTA include the Articles of Agreement, Procedures Manual, and Audit Manual.

The movement to create an agreement on fuel tax was driven by motor carriers, who had become frustrated navigating all the different fuel tax regulations and reporting requirements in each state and province, and who demanded a better way to do things.

- 1983 — A group of government and industry representatives developed a tax collection system inspired by the International Registration Plan (IRP) premise of agreement with a base jurisdiction, for simplified reporting and payment of taxes for fuel usage. Only three states were part of the initial fuel tax agreement: Arizona, Iowa and Washington. Idaho, Minnesota, and Oklahoma are the next states to join the agreement.

- 1984 — Federal legislation authorized the creation of a working group to study how each state collects fuel use taxes for motor carriers.

- 1987 — The IFTA model agreement was adopted by members: Arizona, Idaho, Iowa, Minnesota, Oklahoma, and Washington.

- 1990 — IFTA membership grows to 16 states.

- 1991 — U.S. President George H. W. Bush signs the Intermodal Surface Transportation Efficiency Act (ISTEA) into law which provides funding for the implementation of IFTA and the International Registration Plan (IRP).

- 1992 – Alberta becomes the first Canadian province to join IFTA, with 21 other jurisdictions participating at the time.

- 1996 — On September 30, 1996, a mandate came into effect that required the 48 mainland U.S. states to conform to IFTA requirements for the collection of motor fuel use taxes. Maine, New Hampshire, and Vermont, as members of the Regional Fuel Tax Agreement (RFTA) were not subject to this mandate.

- 2006 — The Dispute Resolution Committee was formalized for hearing disputes from IFTA member jurisdictions and licensees.

What is IRP? IFTA vs. IRP

IRP stands for the International Registration Plan (IRP). While IFTA is an agreement on fuel tax licensing, IRP is an agreement related to vehicle registration for commercial motor vehicle carriers in the U.S., District of Columbia, and Canadian provinces. Similar to IFTA, carriers register their vehicles with IRP only in their home state or province (base jurisdiction).

IRP registration is required for vehicles that are used or intended to transport people or goods in more than one IRP member jurisdiction and meet the following:

- Two axles and a gross vehicle weight (GVW) or registered GVW over 26,000 pounds or 11,793.401 kg

- Three or more axles (regardless of weight)

- Used in a combination with a combined GVW over 26,000 pounds or 11,79.401 kg (also known as apportioned vehicles).

Automated IFTA Reporting with Telematics

Carriers can streamline the process of IFTA management by using a telematics solution to report on accurate GPS location and time in each location of fleet vehicles. Relying on paper records for IFTA can lead to a number of issues such as missing paperwork, entry error, late filings, overpayments, or audits.

Using telematics, or GPS fleet tracking, to track miles by state or province eliminates the manual process, improves the accuracy of distance, and saves time. The telematics device logs the vehicle odometer and GPS position, capturing the daily trips of each vehicle. Entry and exit odometers are calculated. The telematics solution can also help identify any vehicle or device issues to bring to attention of auditor. Geotab’s fleet compliance solution can even generate an automated IFTA report, which can then be sent to a third-party to generate the completed tax forms.

To see how Geotab can help automate IFTA reporting, arrange a free demo with one of our product experts.

Read more about IFTA reporting and telematics on the blog.

Related:

IFTA Reporting and the ELD Mandate

Understanding Your Vehicle Odometer

Big Data and the Smart Fleet Revolution

Subscribe to get industry tips and insights

The Geotab Team write about company news.

Table of Contents

- What Are the IFTA and Non-IFTA Jurisdictions?

- The IFTA Reporting Process

- Do I Need an IFTA Licence?

- IFTA Exemptions

- IFTA Fuel Tax Reporting and Due Dates

- What Are the Penalties for Failing to Comply with IFTA?

- IFTA Auditing

- History of the International Fuel Tax Agreement (IFTA)

- What is IRP? IFTA vs. IRP

- Automated IFTA Reporting with Telematics

Subscribe to get industry tips and insights

Related posts

Multi-stop route planners: A fleet manager's guide + best tools in 2025

June 5, 2025

5 minute read

Geotab: Unlocking value and enhancing K-12 transportation with data-driven fleet management

February 21, 2025

1 minute read

What Is Fleet Management? A Complete Guide for Fleet Managers

January 21, 2025

5 minute read