Freight factoring: What it is and how it works

If you’re struggling with cash flow in your trucking business, freight factoring might help. Learn how it can help you get paid faster and keep your fleet running smoothly.

By Geotab Team

Sep 2, 2025

Key Insights

- Freight factoring is when you sell your unpaid invoices to a factoring company in exchange for immediate payment.

- It boosts cash flow, reduces payment delays and helps with expenses like fuel and wages.

- Freight factoring includes fees, possible hidden charges and may require credit checks on your customers.

- To choose the right partner, look for competitive rates, clear fees, flexible terms and strong customer service.

Running a trucking business often means waiting to get paid — sometimes 30, 60 or even 90 days after delivering a load. That kind of delay can make it hard to pay for fuel, cover driver wages or take on new jobs.

You might be surprised that 60% of small businesses, including trucking companies, struggle with cash flow because of slow-paying customers. And with driver wages climbing 15.5% to $0.724 per mile, according to our trucking industry statistics, it can be a real pain.

That’s where freight factoring can help. It gives you fast access to the money you’ve already earned, without waiting or chasing customers. Learn what freight factoring is, how it works and whether it’s the right fit for your fleet.

What is freight factoring?

Freight factoring is a type of invoice factoring made for the trucking industry. It lets you sell your unpaid freight bills to a factoring company in exchange for quick payment.

Instead of waiting for weeks, you get most of the money upfront. The factoring company then collects payment from your customer. This gives you a steady cash flow to keep your trucks moving, covering fuel, repairs, wages and other daily costs.

Many businesses in trucking logistics use trucking factoring to stay ahead. It’s a simple way to turn delivered loads into cash without taking out a loan or chasing payments.

How does freight factoring work?

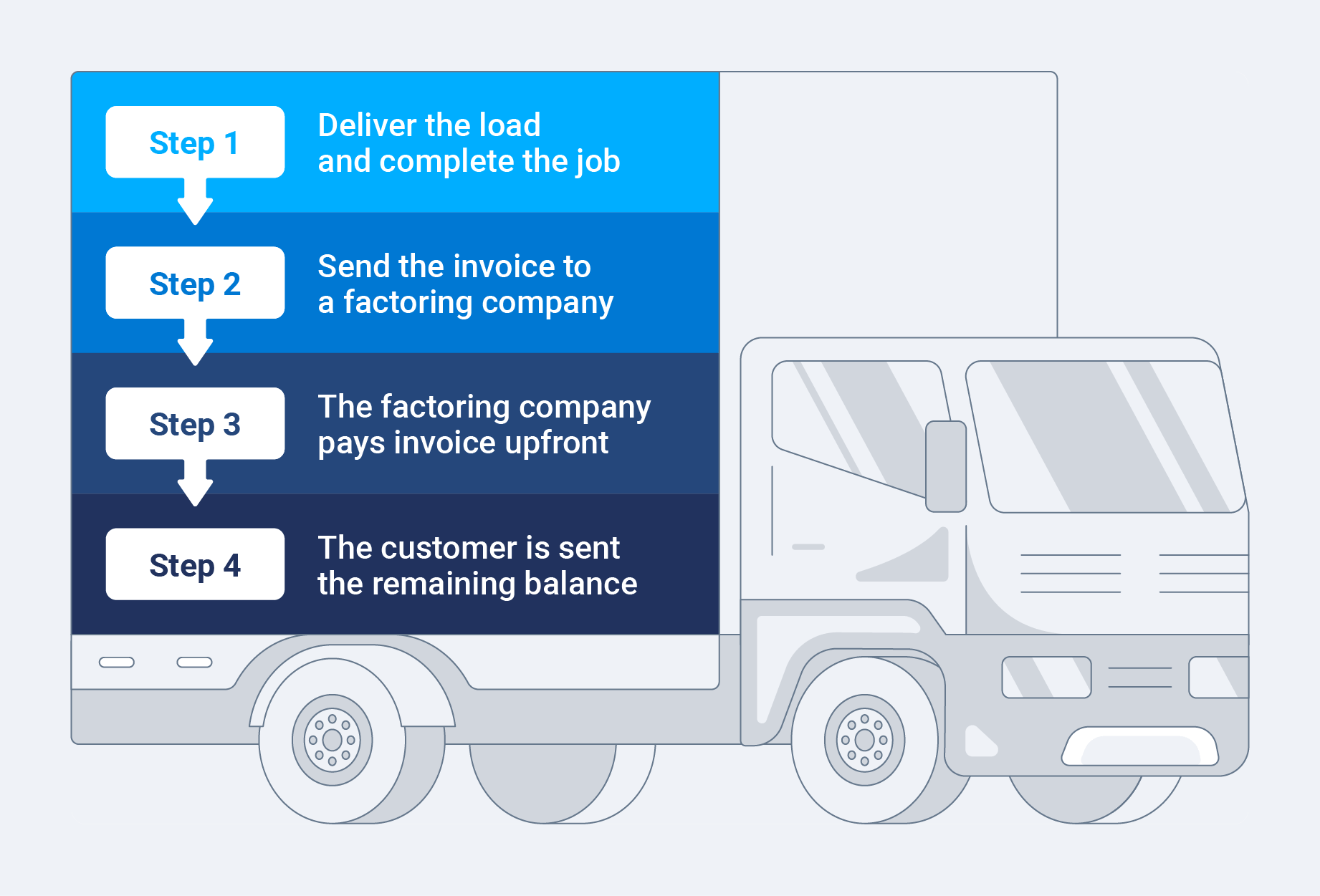

Freight bill factoring is a quick and simple process. Here’s how invoice factoring in trucking works:

- You deliver the load and complete the job like you normally would.

- You send the invoice to a factoring company, along with proof of delivery and any required documents.

- The factoring company pays most of the invoice upfront, often within 24 hours.

- They collect payment from your customer based on the terms you agreed on.

- Once your customer pays in full, the factoring company sends you the remaining balance, minus their fee.

Freight invoice factoring takes the wait out of getting paid, so you can focus on keeping your trucks on the road.

Types of freight factoring

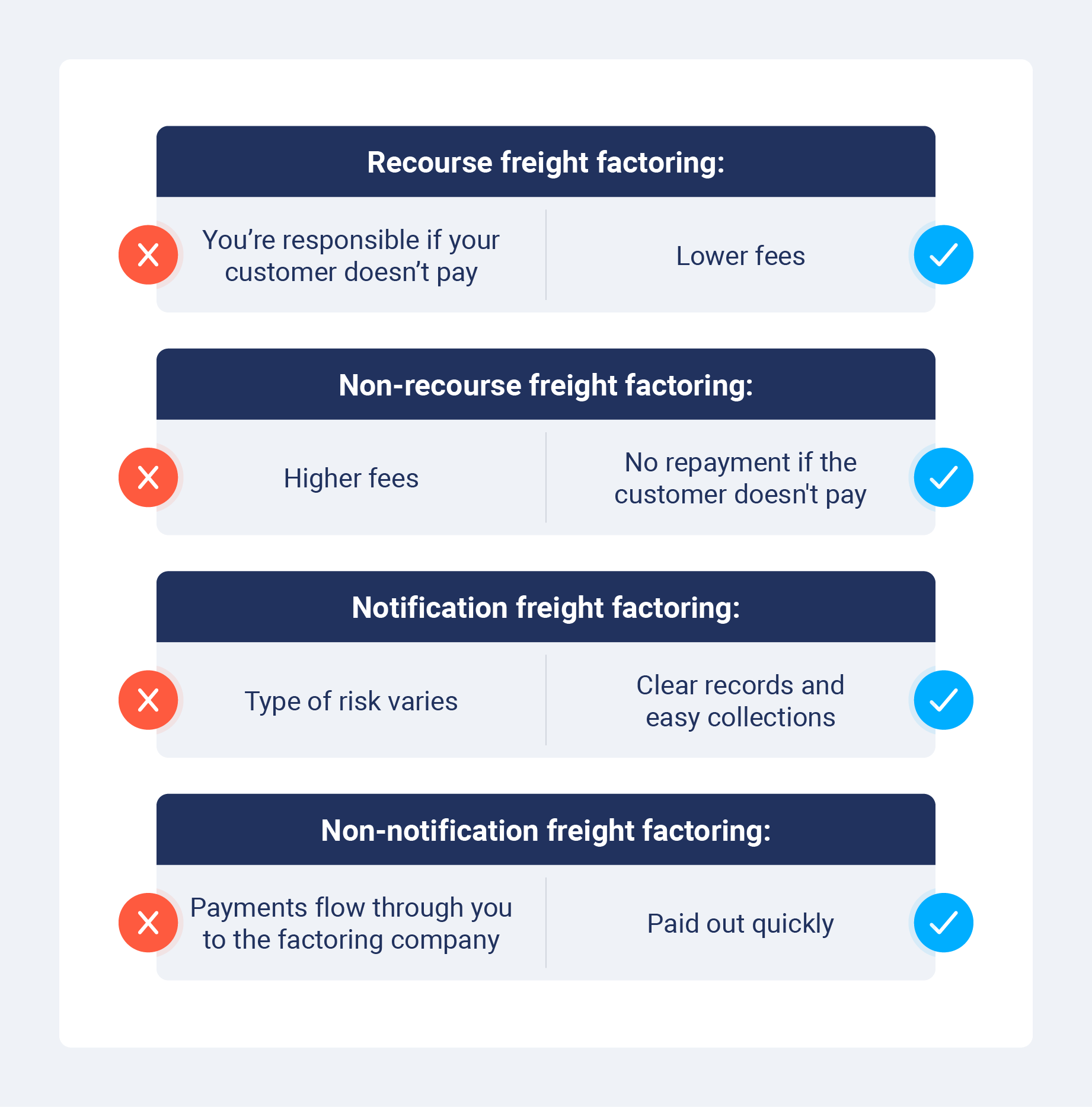

Not all freight factoring works the same way. There are different types, and knowing the difference can help you choose what’s best for your fleet. Some options shift risk, while others focus on how payments are handled between you, your customers and the factoring company.

Here’s a quick peek at the most common types of freight factoring:

Type | Who takes the risk? | Does the customer know? | Best for |

|---|---|---|---|

| Recourse | You (the trucking company) | Usually yes | Lower fees, trusted customers |

| Non-recourse | Factoring company | Usually yes | Extra security with new or risky customers |

| Notification | Varies (recourse or non) | Yes | Clear records, easy collections |

| Non-notification | Varies (recourse or non) | No | Privacy, keeping factoring use confidential |

Recourse freight factoring

With recourse freight factoring, you’re responsible if your customer doesn’t pay. That means if the factoring company can’t collect, you have to buy the invoice back or replace it.

This option usually comes with lower fees, but more risk. It can work well if you know your customers pay on time and you want to keep fleet management costs down.

Non-recourse freight factoring

In non-recourse freight factoring, the factoring company takes on more risk. If your customer fails to pay because of credit issues, you won’t have to repay the advance.

This option often has higher fees but can give you peace of mind, especially if you’re working with new brokers or shippers. It helps make your load factoring more predictable.

Notification freight factoring

With notification factoring, your customer knows you’re using a factoring company. The factoring company sends the invoice and collects payment directly from them.

This is a common setup and helps keep payments organized. It also gives you more time to focus on hauling and predictive maintenance, not chasing checks.

Non-notification freight factoring

In non-notification factoring, your customer isn’t told that a factoring company is involved. You still get paid quickly, but payments may go through your business first and then to the factoring company.

This type keeps your business relationships more private but may involve more coordination on your end.

Advantages of freight factoring

Freight factoring helps you get paid fast without taking out a loan. It’s a smart way to manage cash flow, especially if you’re growing or waiting on slow-paying customers.

Many trucking companies use freight factoring because it helps:

- Get paid within 24 hours of delivering a load.

- Improve cash flow without adding debt.

- Use funds for fuel, repairs or expanding routes.

- Reduce stress from chasing down payments.

- Focus more on driving and operations, not paperwork.

- Improve planning and reduce your total cost of ownership.

- Take on more jobs without worrying about when you’ll get paid.

- Strengthen your relationships with drivers and vendors by paying on time.

- Lower the risk of missing payments on fuel cards or equipment loans.

- Free up time to focus on growing your business instead of managing receivables.

Cons of freight factoring

While freight factoring can be a great tool, it’s not perfect for everyone. It’s important to understand the trade-offs before signing up, such as:

- Factoring companies charge fees (usually a small percentage of the invoice).

- Some plans require credit checks on your customers.

- Some factoring plans may not integrate easily with your telematics or load-tracking systems.

- You may still carry risk with recourse factoring.

- Long-term contracts can limit flexibility.

- Using factoring too often may hide deeper cash flow issues.

- You’ll need to share documents, like rate confirmations and proofs of delivery.

- It could affect how underwriters view your business for commercial truck insurance.

How to choose the right freight factoring company

Each factoring company works differently. Choosing the right one can make a big difference in how smoothly your cash flow runs and how well you manage your fleet maintenance costs. Look for a partner that fits your business needs and helps, not hinders, your operations.

Here are some key things to consider while choosing a freight factoring partner:

- Rates: Look at the advance rate and factoring fee. Some companies offer up to 98% of the invoice amount upfront. The lower the fee, the more cash you keep.

- Terms: Check if the contract is month to month or long term. Also, ask about volume requirements or minimums. Flexible terms make it easier to scale up or down.

- Application process: A simple and fast setup saves time. Some companies approve accounts in a day and let you start factoring right away. Others may ask for more paperwork.

- Fees: Beyond the main factoring fee, look out for hidden charges like setup fees, credit check fees or early termination fees. Make sure all costs are clear upfront.

- Reputation: Read reviews or ask other fleets about their experience. A good factoring company should offer fast service, strong customer support and transparent practices.

Alternatives to freight factoring

Freight factoring isn’t the only way to improve cash flow. Depending on your fleet’s needs and size, you may want to explore other options.

Here are a few common alternatives to using a factoring trucking company:

- Business line of credit: Borrow funds as needed and only pay interest on what you use. It’s flexible but may require strong credit and collateral.

- Fuel cards with extended payment terms: Some fuel cards offer longer repayment windows or rebates, helping you manage fuel costs without needing upfront cash.

- Quick-pay programs from brokers: Some freight brokers offer early payment options for a small fee — no third-party factoring company involved.

- Working capital loans: These short-term loans can help cover day-to-day costs but often come with higher interest rates.

- Equipment financing or leasing: Instead of paying upfront, you spread out the cost of new trucks or trailers over time, freeing up cash for other needs.

- Self-funding with savings or retained earnings: If your fleet has strong reserves, using your own funds avoids fees or contracts, though it may limit how fast you can grow.

Optimize fleet management and save with Geotab

Freight factoring can be a powerful tool to keep your cash flow steady, allowing you to focus on running your fleet without worrying about delayed payments. By freeing up working capital, you can ensure your trucks stay on the road, drivers get paid on time and your operations keep moving smoothly. This means effortless fleet management.

But optimizing your fleet goes beyond factoring. Geotab’s fleet optimization software can help you reduce costs, improve efficiency and make smarter decisions with real-time data. From predictive maintenance to fuel savings, it makes it easier to manage every aspect of your fleet.

Book a free demo today to learn how Geotab can help you optimize and save.

Subscribe to get industry tips and insights

Frequently Asked Questions

Yes, freight factoring can be worth it if you need fast access to cash without taking on debt. It’s especially helpful for businesses that deal with slow-paying clients, as it keeps your cash flow steady and lets you focus on running your fleet.

The cost typically includes a factoring fee, which is a percentage of the invoice amount. Fees usually range from 1% to 5%, depending on the factoring company and the volume of invoices. Some companies may also charge additional fees for services like credit checks or setup.

Factoring companies assess risk by reviewing your customers' creditworthiness. They may look at your customer’s payment history, credit scores and reliability. The more reliable your customers are, the lower the risk and the lower your fees.

The Geotab Team write about company news.

Table of Contents

Subscribe to get industry tips and insights

Related posts

Telematics trends for 2026: What is changing and how fleets can respond

January 30, 2026

6 minute read

Fleet GPS tracking systems cost: Full price breakdown and ways to boost ROI

January 30, 2026

6 minute read

Fleet operations: Key components, benefits and challenges

January 7, 2026

4 minute read

.jpg)

10 best fleet management software to boost performance and cut costs

December 22, 2025

8 minute read

The $4B Crisis: Video Intelligence as the Answer to Fleet Distraction

December 2, 2025

3 minute read