IRS mileage log requirements for 2025 [free downloadable template]

Unlock maximum tax savings and ensure IRS compliance for your fleet in 2025 with accurate mileage tracking.

By Geotab

Jul 15, 2025

Key Insights

- Mileage tracking is the process of recording the distance a fleet vehicle travels over a specific period using an IRS mileage log template.

- While manual logs are acceptable, utilizing digital tools, apps or integrated fleet management systems can significantly simplify and improve mileage tracking accuracy.

For fleet managers, effective IRS mileage log management is the key to ensuring accurate tax deductions and IRS compliance. The IRS mandates thorough documentation to support vehicle expense claims, and inconsistencies or inadequate records across your fleet can result in disallowed deductions and potential audits.

This includes capturing essential fleet data analytics for every trip, such as dates, origins and destinations, the specific business purpose and the precise miles each vehicle drives.

Let's dig into the details of mileage tracking and what you need to keep your fleet IRS compliant.

What is mileage tracking?

Mileage tracking is the process of recording the distance a vehicle travels over a specific period. For fleets, this involves diligently documenting the miles driven by each vehicle before a trip and after, using a log or software tool.

Mileage tracking typically includes details such as the:

- Date of the trip

- Origin and destination

- Specific reason for the travel (e.g., client meeting, delivery)

- Number of miles covered

Accurate mileage tracking is crucial for several reasons, most notably for cost management (fuel, maintenance), operational efficiency analysis (route optimization) and compliance with regulatory requirements, including those set forth by the IRS.

IRS mileage rates

The Internal Revenue Service (IRS) establishes standard mileage rates that fleets and individuals can use to calculate the deductible costs of operating vehicles. These rates are periodically reviewed and may change to reflect fluctuations in the cost of operating vehicles, such as fuel and maintenance expenses.

2024 rate | 2025 rate | |

| Business | $0.67 per mile | $0.70 per mile |

| Medical | $0.21 per mile | $0.21 per mile |

| Charity | $0.14 per mile | $0.14 per mile |

| Active-duty military moving | $0.21 per mile | $0.21 per mile |

Understanding IRS mileage log requirements

An acceptable IRS mileage log must contain key details for each trip, which drivers should record at or near the time of the travel.. Failing to maintain a comprehensive and accurate mileage log can lead to the disallowance of the vehicle expense deductions during an audit. It could also result in additional taxes, interest and penalties.

Using a consistent mileage tracking method is crucial for ensuring compliance and maximizing deductions. Acceptable methods include a paper log, a spreadsheet or a dedicated vehicle monitoring system.

What to include in your mileage log

An IRS-compliant mileage log will capture specific information for every business-related trip. Consistently recording these details ensures you have the necessary documentation to claim deductions and avoid potential issues during fuel tax audits.

- Date of the trip: When the travel occurred.

- Starting and ending points: The specific locations of departure and arrival.

- Annual fleet mileage: This is the total number of miles you accumulated for business-related purposes throughout the tax year. It’s the key figure used to calculate your deductible expenses based on the IRS mileage rate.

- Per-use fleet mileage: For each individual business trip, drivers will need to record the exact number of miles they’ve driven from the starting point to the destination. This provides a granular breakdown of your fleet travel.

- Date of use: Clearly note the specific date on which each business trip occurred. This establishes the timeline for business travel activities.

- Business destination: Record the specific address or location you traveled to for business purposes. This provides context for the trip and can help verify its business nature.

- Purpose: Provide a brief but clear explanation of the business reason for the trip. Be specific, such as "client meeting with [Client Name]," "delivery of goods to [Customer Name]," or "site visit at [Project Location]."

Mileage log templates + tracking solutions

Maintaining an IRS-compliant mileage log doesn't have to be time-consuming. Several methods and tools are available to help drivers accurately record travel. Choosing the right approach depends on your fleet’s individual needs and the complexity of each vehicle’s usage.

| Method | Pro | Con |

| Paper | Simple to start and requires no technology | Prone to errors and can be time-consuming to organize |

| Spreadsheets | Offers some organization and allows for basic calculations | Still requires manual data entry and can be inconvenient on the go |

| Software | Often automates tracking via GPS for accurate mileage calculation and provides digital records | May have a subscription cost and require a smartphone or dedicated device |

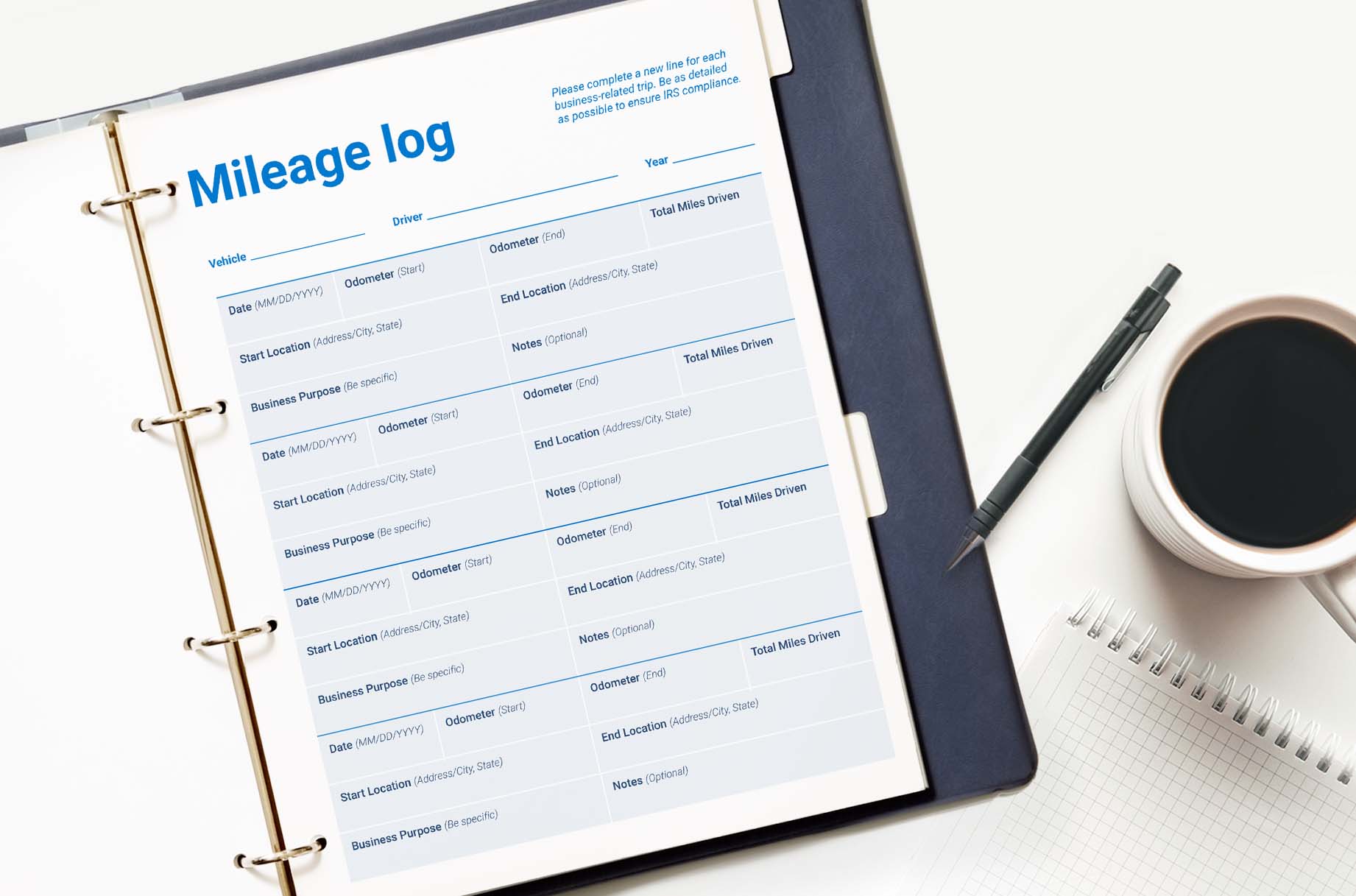

Printable mileage log template

A printable mileage log template offers a straightforward solution for those who prefer a hands-on approach or have simpler mileage tracking needs. This method involves manually recording trip route optimization details on a physical sheet of paper.

Keep in mind that manual tracking can be more susceptible to human error, omissions and the potential for lost records compared to digital methods. However, the simplicity and lack of reliance on technology may be appealing to some.

Pros:

- Simple and requires no technology

- Provides a tangible, physical record

- Easy to understand and use

Cons:

- More prone to manual errors and omissions

- Can be time-consuming to fill out for frequent trips

- Risk of losing or misplacing the log

- Requires manual calculations for totals

To get started with manual tracking, you can download our free printable mileage log template.

Free printable mileage log PDF

Spreadsheet mileage log template

A digital mileage log spreadsheet offers a step up from paper logs — it provides a structured format and the ability to perform basic calculations. While still requiring manual data entry, a well-designed spreadsheet template can help organize your mileage data and reduce some of the errors associated with handwritten logs.

However, like paper logs, spreadsheets like Excel still require you to manually record trip details, which can become time-consuming for individuals or fleets with frequent travel.

Pros:

- Offers better organization than paper logs

- Allows for basic calculations and totaling of mileage

- Can be customized to include specific data fields

Cons:

- Still requires manual data entry for each trip

- Potential for data entry errors

- Not ideal for on-the-go recording

To streamline your mileage tracking with a digital format, you can download our free mileage log templates.

Mileage log template for Excel

Mileage log template for Google

Mileage tracking software

For the most efficient and accurate method of tracking mileage, dedicated software or mobile apps offer significant advantages. These solutions often leverage GPS technology to automatically record trips, calculate distances and even categorize drives based on your preferences.

While some may charge a subscription fee, the automation of mileage tracking software can save considerable time and reduce the risk of errors. They ensure more accurate records for IRS compliance and potential tax deductions. Many apps also allow for easy reporting and integration with other business tools.

Pros:

- Automates mileage tracking using GPS

- Provides accurate distance calculations

- Simplifies trip categorization and reporting

- Offers digital records that are less likely to be lost

- Some integrate with accounting and expense management systems

Cons:

- Requires a smartphone or dedicated device

- Reliance on technology and potential battery drain

- Privacy concerns for location tracking may arise for some users

Tips to automate fleet mileage tracking

For fleet managers overseeing multiple vehicles and drivers, automating mileage tracking is key to maximizing efficiency, ensuring accuracy and minimizing administrative burden.

Implementing the right technology and strategies can significantly streamline the process of capturing and reporting vehicle mileage for IRS compliance and internal cost management.

- Customize reports: Configure your fleet management software to generate detailed mileage reports segmented by vehicle, driver, date range and purpose. This allows for easy review and identification of trends, ensuring accurate reporting for tax purposes and internal analysis.

- Combining geofencing with trip history: Set up geofences around frequently visited locations (e.g., client sites, depots). When vehicles enter or exit these zones, trips can be automatically logged and cross-referenced with trip history to verify accuracy and identify potential discrepancies.

- Utilize odometer data validation: Implement systems that allow for the regular input of odometer readings and flag any significant discrepancies between GPS-based mileage tracking and manual odometer entries. This helps identify potential errors or inconsistencies in fuel tax reporting.

- Integrate your expense management software: Connect your mileage tracking system with your expense management software to streamline the process of reimbursing drivers for business mileage. Automated data transfer reduces manual data entry and ensures accurate and timely reimbursements based on actual miles driven for business purposes.

Streamline mileage tracking with automated vehicle tracking data

Effectively managing your fleet's IRS mileage log requirements is crucial for tax compliance and cost control. Beyond basic mileage logging, leveraging automated vehicle tracking data offers a powerful way to enhance accuracy and efficiency in your record-keeping.

Learn more about how Geotab's vehicle tracking and fleet fuel card solutions can automate your fleet's mileage tracking and streamline your compliance efforts.

Subscribe to get industry tips and insights

Frequently Asked Questions

A contemporaneous record of the date, starting and ending points, business purpose and miles driven for each business trip.

Ideally, immediately before and after each business trip, to ensure accuracy and contemporaneity.

Yes, the IRS requires detailed and accurate mileage logs to substantiate any claimed vehicle expense deductions during an audit.

While not explicitly mandated for every single trip, recording odometer readings at the beginning and end of the year (or when you start using the vehicle for business) is highly recommended to support the accuracy of your mileage log.

At a minimum, the date of the trip, starting and ending locations, the business purpose of the trip and the number of miles driven.

Geotab team

Table of Contents

Subscribe to get industry tips and insights

Related posts

Best ELD for trucks: Top devices for compliance and safety [2026]

December 18, 2025

6 minute read

Best ELD for owner operators: Top 6 picks and how to choose one

December 1, 2025

6 minute read

Infographic: Upgrading your cold chain solution to minimize waste and maximize profit

September 11, 2025

1 minute read